Dispatch 038: Meta Miscues

And here I was, not even a week ago, thinking social AI characters would be Meta's next blow-up/blunder. Silly me. I mean, to be fair, it still might be depending on the timing of the launch and how fast Meta's starts the moderation pull-back on their various services. But that transition is clearly going to bring a greater world of pain that the company – well, Mark Zuckerberg, at least – seems content to deal with as it happens. Still, AI-generated fake social content on existing networks? I'm taking the under on this bet...

I Think...

💰 AI Startup Anthropic Raising Funds Valuing It at $60 Billion – Well, they found someone to put a price on the $4B Amazon invested a couple months ago (on a note). At $60B, Lightspeed has to believe that Anthropic's exit potential is at least $180B (3x), which undoubtedly means IPO or bust now – sorry, Amazon (though you're still the backstop here if things slow down substantially – they clearly own well over 10% of the company at this point, the question is if they own over 20% and if so, how much more? They may even own over 30% at quick glance, depending on terms, of course). Amazon's $4B plus this $2B gives Anthropic roughly the same amounts as OpenAI and xAI just raised. One aside: I've seen some talk that OpenAI's revenue is roughly 4x where Anthropic currently sits, but per this reporting, OpenAI's number would seem to be actual revenue whereas Anthropic's is ARR (an extrapolation) – so the gap, seemingly, is wider. Still, the valuation gap is roughly 3x now, so hopefully Anthropic is growing faster... Though OpenAI will undoubtedly raise again soon enough at a higher number – perhaps once the for-profit transition is done. [WSJ 🔒]

🦋 Bluesky is Being Valued at Around $700 Million in a New Funding Round – Speaking of funding, I'm fairly torn on this one. On one hand, many elements of Bluesky are great and make it feel like the new (old) Twitter. On the other, I'm still not sold that a company like Twitter can really thrive as a venture-backed business in 2025. I would much rather see it be a full-on non-profit type entity – yeah, yeah, insert the OpenAI joke here. All sides can and will say the right things about the mission, but ultimately, the actual incentives always melt the best intentions. Bluesky will now need to be a multi-billion-dollar company in relatively short order and they've said they don't want to do advertising so... (Narrator: they will eventually do advertising as it becomes clear other forms of monetization aren't scaling.) Rooting for them, but I think I've seen this film before. And I didn't like the ending. [BI 🔒]

📺 The King of Network TV Wants Just 30 Minutes of Your Time – A profile of Dick Wolf, the man behind all of those procedural dramas (nine of them are currently running) on network TV – Law & Order, Chicago Fire, etc. His first streaming series, On Call, launches this week on Prime Video. Sort of strange that Amazon only ordered 8 episodes, but perhaps the slight shakeup in his old steady formula has something to do with it: episodes are just 30 minutes long and because they're not on network TV, are more violent. (Also, it reads like it's more the brainchild of his son, Elliot Wolf.) In our age where nearly every streaming show is an hour (or more), I appreciate this. Sometimes it's nice to have something that's a bit faster to watch and that's not a sitcom. The Bear seemed to benefit from this as well, at least early on. Also, the content type seemingly fits perfectly with Prime Video where shows like Reacher and Bosch seem to reign supreme. Also, also: this show almost started life on Quibi! [NYT]

🍪 Nvidia CEO Has Plans for Desktop Chip Designed with MediaTek – I noted yesterday how NVIDIA's partnership with MediaTek to develop an ARM-based chip for their new Project DIGITS home AI machine seemed interesting. As it turns out, Jensen Huang was happy to tell everyone a bit more – to the point where it's sort of surprising how open he's being about their intentions here. While he didn't exactly give specifics, he did note the plan was to make "a mainstream product" – i.e. not just something for AI developers. To be clear, he seemed to be talking about the Linux-based OS they've created to run on these chips, but as for the chips themselves as desktop CPUs, "You know, obviously we have plans." Can NVIDIA really come at that market while everyone else is gunning for them from the opposite (and every other) end? I mean if they do want to become the new (old) Intel... [Reuters]

I Note...

- Piers Morgan is moving from News UK and going all-in on his own YouTube channel... [Sky News]

- With the ban date looming, TikTok is clearly pushing users over to Lemon8, just in case they aren't saved at the last minute. The only problem: since it's also owned by ByteDance, the new service could also be banned under the same law. This isn't like a game of three-card monte... [Axios]

- Though maybe that third card in which to hide could be Melolo, yet another new short-form video service (this one focused on scripted content) just launched by ByteDance. [Information 🔒]

- Amongst the first services to be disrupted by AI will be the stock photography companies, so it makes sense that Getty Images and Shutterstock would merge – celebrity wire photos should retain more value. [THR]

- Some thoughts from Neal Mohan on the state of YouTube and how AI will fit in – also the FT tries to corner him into answering if he's in the running to be Alphabet/Google's overall next CEO (which he dodges). [FT 🔒]

- Is Google on to something with AI-generated news briefs for their Google TV platform, or is it just another tech TV gimmick? [TechCrunch]

- One of the former co-leads of OpenAI's Sora who jumped over to DeepMind (as noted in October), Tim Brooks is working on an AI project to simulate the physical world – an area that is clearly heating up, quickly. [TechCrunch]

- The EU's General Court has now fined their EC arm for failing to comply with data protection rules, prompting the old existential question: if you were a hot dog, and you were starving, would you eat yourself? [Reuters]

- Sensing a trend here... perhaps they're gearing up to fine their own bodies if they can no longer push around US tech companies? Awfully quiet on that front these past few weeks. Of course, they're likely just on holiday...

- Back in growth mode, James Daunt seemingly has Barnes & Noble (and Waterstones in the UK) on track for a future IPO... [FT 🔒]

- So much for Apple solving their iPhone ban in Indonesia by way of a large investment – "If it is $1 billion, then that is not enough." Maybe Indonesia's minister of industry, Agus Gumiwang Kartasasmita, should go work for Apple – tough negotiator! [Reuters]

- RadioShack is back – well, the brand anyway, on some peripherals. [TechCrunch]

- A potential hold-up in OpenAI's first agentic releases? More safeguarding required against prompt injection attacks. But such a release could be just around the corner... [Information 🔒]

I Quote...

"We don’t make Ferraris. We make S-class Mercedes that are beautifully built and run forever."

-- Rick Rosen, the WME agent of Dick Wolf, relaying how Wolf likes to describe his own shows in the era of slick (and expensive) television productions.

I Spy...

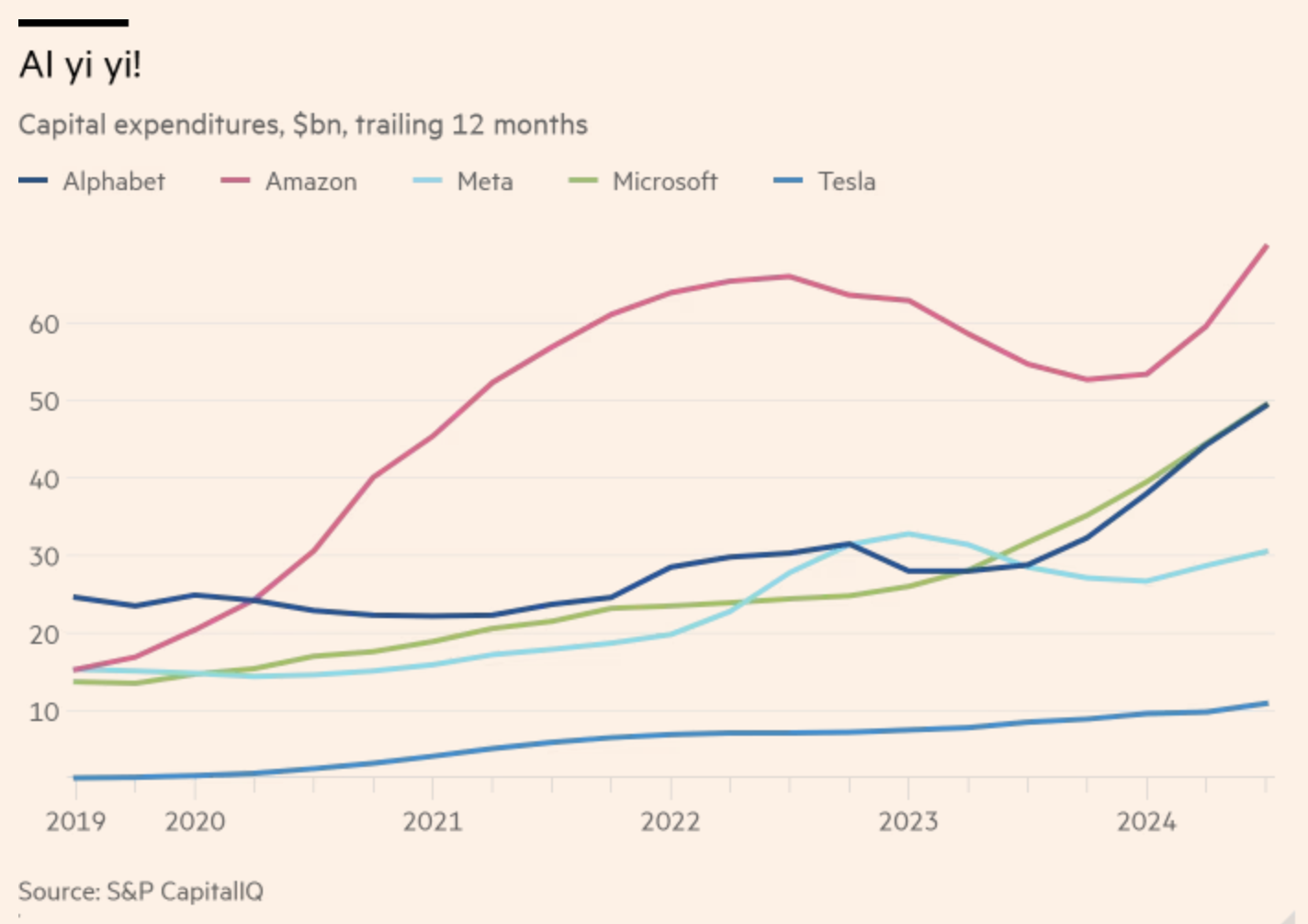

An overview on the Capex spend by the 'Magnificent 7' (well, 5 of them anyway, since Apple's has remained steady with AI expenses being at least somewhat outsourced to partners and NVIDIA is on the receiving end of most of this spend). As Robert Armstrong notes:

This is cash out the door today, but the expense will only appear in earnings per share over time. The AI arms race has not fully hit profits yet. The question is whether the market has digested the fact that it must do so before long.

Right now, the market is pricing in no margin compression as a result of this spend so they're clearly betting on continued revenue growth at strong paces – either in the core businesses or that AI will more than offset any core slowdowns. It's... a bet. At least one of those companies has no such growth at the moment, but well, they're already being valued a bit differently...

This is going to be the dynamic everyone is watching every quarter in 2025...