ESPN's Spaghetti-to-Wall Streaming Strategy

Just in case you were wondering when the NFL found out about Disney's new sports streaming bundle partnership, the answer is apparently when the rest of us did:

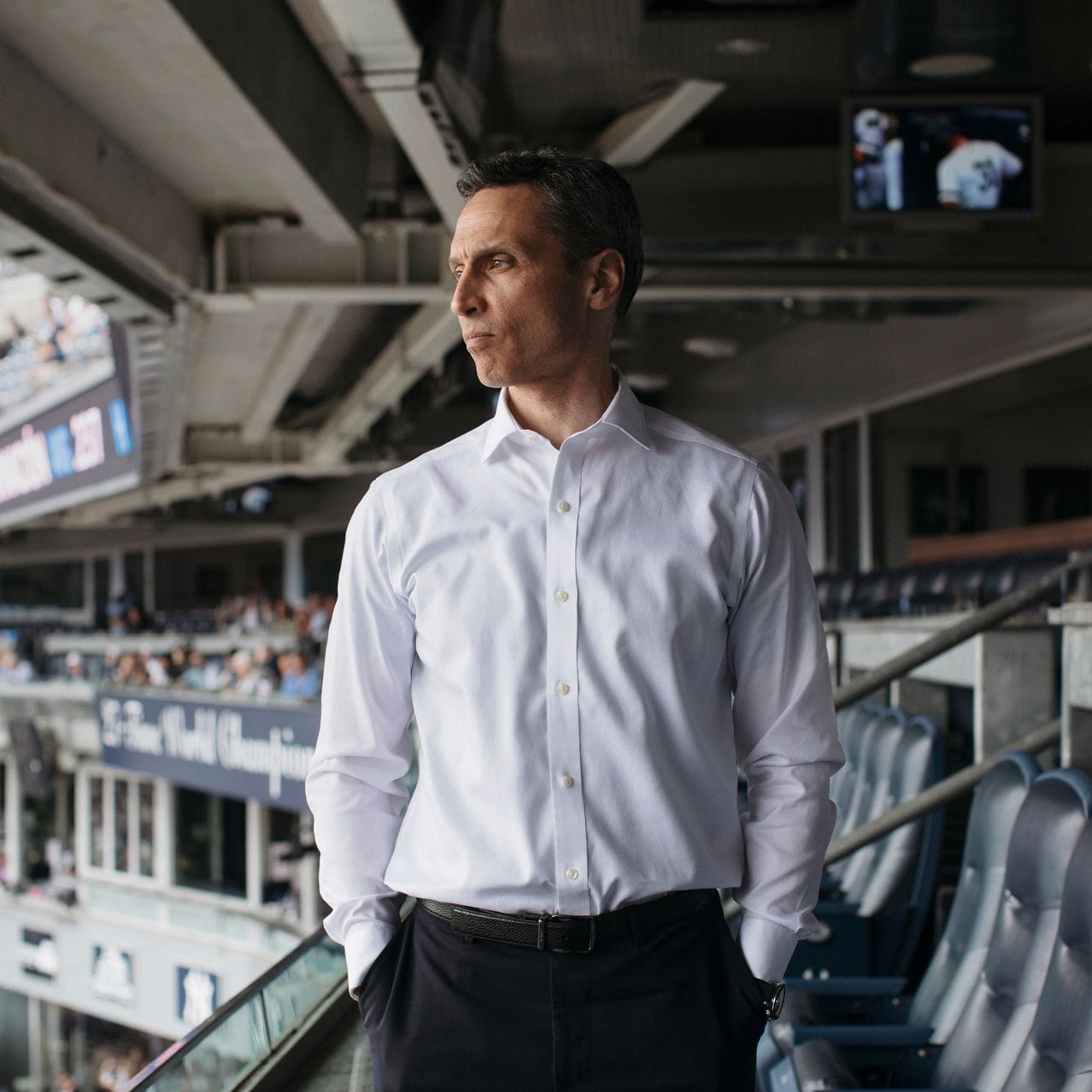

ESPN boss Jimmy Pitaro was keeping a big secret.

In January, Pitaro and executives at ESPN-parent Disney hosted a contingent of top NFL officials—including Commissioner Roger Goodell, and team owners Robert Kraft and Jerry Jones—at Disney’s Burbank, Calif., headquarters to discuss a potential deal. On the table was a strategic partnership that would involve the NFL taking an equity stake in ESPN and coordinating streaming and TV efforts, said people familiar with the talks.

What the league didn’t know: Pitaro’s team at ESPN was quietly working on a totally separate deal to join forces with rival media companies on a sports-streaming service. When that venture was announced in February, the league was blindsided—and furious at being out of the loop.

As he gathered a few days later at the Super Bowl in Las Vegas with his team and a gaggle of sports celebrities, Goodell complained to one associate, “Why would Disney treat a partner this way?”

😬

I'm still not sure I fully understand the rationale for the new streaming service. My guess was that it was a way for Bob Iger to talk about ESPN's further foray into streaming on an earnings call, while Disney was still a year-plus away from the actual new ESPN streaming service. But they are apparently taking it quite seriously. And again, they announced it even though it clearly pissed off their partners.

This profile of ESPN head Jimmy Pitaro cites "volatility":

Volatility in the media world forced Pitaro to pursue multiple streaming strategies at once, despite the risk of keeping a powerful league partner in the dark. He’s gambling that ESPN will build a big enough digital business to fill the financial hole being created as millions of Americans continue to cut the cable-TV cord.

So, trading volatility in streaming for volatility in partnerships? Okay. But the bigger question/issue I have is just user confusion. So do I subscribe to ESPN content via ESPN+, a vMVPD like Disney's Hulu Plus Live TV, this new sports streaming service coming this fall, or the new new ESPN streaming service coming next year? The answer, from Disney's perspective, I guess, is that they don't care. Pick one. Or two! But I'm not sure the market is going to fully understand the options here.1

About a year ago, Pitaro ordered the network to lay the groundwork for a direct-to-consumer ESPN service featuring all the programming from the flagship TV channel. There were major risks. How would cable distributors who pay to carry the ESPN TV channel react? What if the plan accelerated the death of cable without replacing its riches? Pitaro batted around those issues with his team and pressed ahead.

A year ago strikes me as too long to have waited – of course, I've been harping on this for a decade – and perhaps is what led to this new, hybrid bundle as a stopgap measure. Because yes, the cable system is collapsing and there's no stopping it, regardless of what ESPN does or doesn't do.

Pitaro had begun to think there was an opportunity to give consumers an option beyond that single ESPN streaming service, which is continuing in development and will likely cost around $30 a month.

He imagined a bigger sports platform in partnership with other media companies. The idea was that while some people might only need ESPN programming, others might want to see games carried on other channels and would be willing to pay more for that.

Executives at other companies, including Fox Corp. CEO Lachlan Murdoch and Warner Bros. Discovery chief David Zaslav, had been thinking along similar lines, and before long the rivals were in deep talks.

Yes, of course Warner Bros. Discovery and especially Fox think that: they have no prospects for their own sports streaming service. But again, ESPN is now flooding the market with options. Maybe that works thanks to different price points – as noted the new ESPN service should be around $30/month while the ESPN/Fox/WBD thing should be around $50/month – but again, maybe it just causes confusion. Especially because that latter bundle won't have a lot of sports content people will want, like many NFL games aired on NBC and CBS properties.

Again, I don't really get it. I think I get it as a strategic announcement ahead of the "real" ESPN streaming service, but now it all seems a bit muddled. And I really don't get even just risking angering that most-important league partner:

Pitaro called Goodell shortly before the company’s press release went out, which the NFL didn’t see as a legitimate heads up, according to people familiar with the matter. Irritating the NFL, which decides which networks carry which games and can be a major ally for ESPN in the streaming business, was risky.

Disney executives said confidentiality agreements prevented them from sharing information about the sports joint venture with league partners.

One you're in the midst of talks about a potential strategic investment, no less. And as if the stakes weren't already high enough for Pitaro:

How the new streaming joint venture performs will be a major piece of Pitaro’s legacy as ESPN’s top executive. If the price point is too high and it fails to win over enough consumers, ESPN will have to find new ways to establish itself in the streaming world. If the service is successful, it could reshape the sports-media landscape and improve Pitaro’s chances of winning Disney’s top job.

This profile definitely angles it a bit like he's bungling it, but we'll see. A report in The Athletic today states that Disney's top targets for an ESPN strategic investor/partner are the NFL and/or NBA. If Pitaro can land those, all is likely forgiven. But if he can't...

1 I suppose they'll say, at least right now, that any such problem wouldn't fully exist until the launch of new ESPN in the fall of 2025, so they have time to think about/address any would-be market confusion. But they can just ask WBD how constantly throwing the HBO brand into the branding chaos machine has worked.