Laughing Away from the Bank 📧

Hello to the wave of new readers coming in from the post about the Venture Capital "Crisis". Hopefully you'll also enjoy some thoughts on... the complete face-plant of the Joker sequel at the box office. Not a Megalopolis-level bellyflop, but in many ways far worse because of the massively successful – and interesting! – first film and how much it cost Warner Bros to get a sequel made. And especially when you consider what it could have been for DC...

Also, I continue to be intrigued by Epic's ongoing work to make the Metaverse happen – even if the company called Meta is now more focused on other things like AI and AR. Unreal Engine may ultimately hold the keys to such a kingdom. Including the Magic Kingdom... might Disney help Epic unify the competing interests – and repair the relationship with Apple?

Some Thoughts...

🍎 Apple Slowly Moves Away From Its Annual Release Strategy – Mark Gurman notes how Apple has slowly but surely been moving away from all-at-once releases as synchronizing the increasingly sprawling product line-up has become untenable – especially with new features like AI. Blowing up this cadence – at least for software – is long overdue as it was feeling unnaturally forced and bugs were creeping in. This complaint comes up every few years with software iterations focused on streamlining and bug fixes temporarily alleviating the issues, but again, the whole operation is too unwieldy now. Related, Gurman says the first iteration of Apple Intelligence will roll out on October 28 – but still with relatively few features (no ChatGPT integration or Genmoji, for example). And new Mac hardware should ship on November 1. Given that Apple earnings are also on October 31, that's a busy week! I assumed given that later timing that Tuesday the 29th might be the date of any fall event, but perhaps they do it the week before to help spread out the madness a bit? Or do they do a rare Monday event again? (Gurman only says "Late October.) [Bloomberg 🔒]

🗳️ Ben Horowitz Plans "Significant" Donation to Kamala Harris – The generous read on this is that the move from Biden to Harris changed the equation. Of course, so far, the policies don't seem like they'll be all that different – hopefully Harris is more pro-business, but we'll see. So the less generous read is that this was all about backing the winner – pretty standard VC move – and the change atop the ticket changed Trump from a likely winner to a likely loser... [Axios]

📺 Anchorman – Interesting backstory from Dylan Byers at Puck as to why Brian Williams is doing the live, election-night coverage for Amazon. Long story, short: this would seem to be less about Amazon's ambitions in the space and more that Williams' team pitched the idea. And they pitched it to Netflix first, who passed. Still, it's an interesting concept for Amazon to try – especially given their ad push and what they're trying to do with live sports. [Puck 🔒]

🎞️ With ‘Megalopolis,’ the Flop Era Returns to Cinemas – I think this captures why I've been interested in this film despite the fact that it was seemingly going to be a huge bust from the get-go. Sometimes these big swings (and bigger misses) stand the test of time better than just your normal box office bomb – and that's more likely if it's a true auteur-driven effort. Perhaps even more so if they sold a family wine business to self-finance? It's also quite possible that the film is just bad and an ego-driven misstep. [NYT]

💰 OpenAI Funding Fuels Wave of Big AI Deals – There's striking when the iron is hot and then there's striking when it's face melting. On the heels of the $6.6B OpenAI fundraise, it would probably be easier to list the AI startups that weren't fundraising (or open to it). Is this smart? I mean, probably not for most of them as it just raises the stakes and thus, the barrier at which they can be hackquired. But if VCs are looking for deals – and nearly everything looks like a deal compared to a $157B valuation – you see how this plays out... [The Information 🔒]

🤖 AI's Big Gift to Society is…Pithy Summaries? – Reading Steven Levy's latest newsletter reminded me of a post I wrote nearly a decade ago (!), well before the current AI boom, of course, thinking about how an early Facebook bot to automate birthday greetings would lead to a bot thanking those bots for the birthday greeting. Now with our far more advanced capabilities, as we start to have AI summarize everything, we're clearly going to have AI writing so as best to be summarized by said AI. Robert Caro, this is not. [Wired 🔒]

Some Analysis...

Some Links...

- As expected, and now hoped – after some early jitters – Amazon is likely to officially pick up the third season of The Rings of Power shortly... [THR]

- Hodinkee (a longtime GV portfolio company) joins with Watches of Switzerland and founder Benjamin Clymer is coming back on board full time. Here's Clymer's note on the move. [NYT]

- Facebook isn't really the Facebook you likely started using anymore, it's more like a hybrid of local content, short videos, communities, and marketplaces. A hodgepodge of stuff – whatever works for the youths. A new design just aims to underscore this new reality. [TechCrunch]

- With a crackdown on gambling services advertising in the Premier League, crypto companies are stepping up to pick up the slack... I shall leave it for you to decide if that's better or worse! [Bloomberg 🔒]

- The new Vitals app included as a part of watchOS 11 may be able to accurately predict an impending illness thanks to pulling in a bunch of data signals from your body. In general, I've found this to be true with such data (body temp, respiratory rate, etc), but this app packages it together in a way that's easier to parse. [MacRumors]

- The efforts by Samsung to compete with TSMC in contract chip manufacturing don't seem to be bearing much fruit, but are definitely bearing much cost. Still, there's no plans to spin off the unit. This mainly just reminds me that we went a few days without any bad Intel news. Congrats? [Reuters]

- While all the focus remains on LLMs, Apple continues to push AI work a bit further afield, here, quite literally with depth sensing. So you could, say, map the fur depth of a ferret... [VentureBeat]

A Golden Oldie...

And I Quote...

"It’s like there’s metaverse weather. Some days it’s good, some days it’s bad. Depends on who’s doing the talking about it."

-- Tim Sweeney, discussing on the term (and concept) of the "metaverse" falling out of favor with the rise of AR, AI, and everything else.

A Chart...

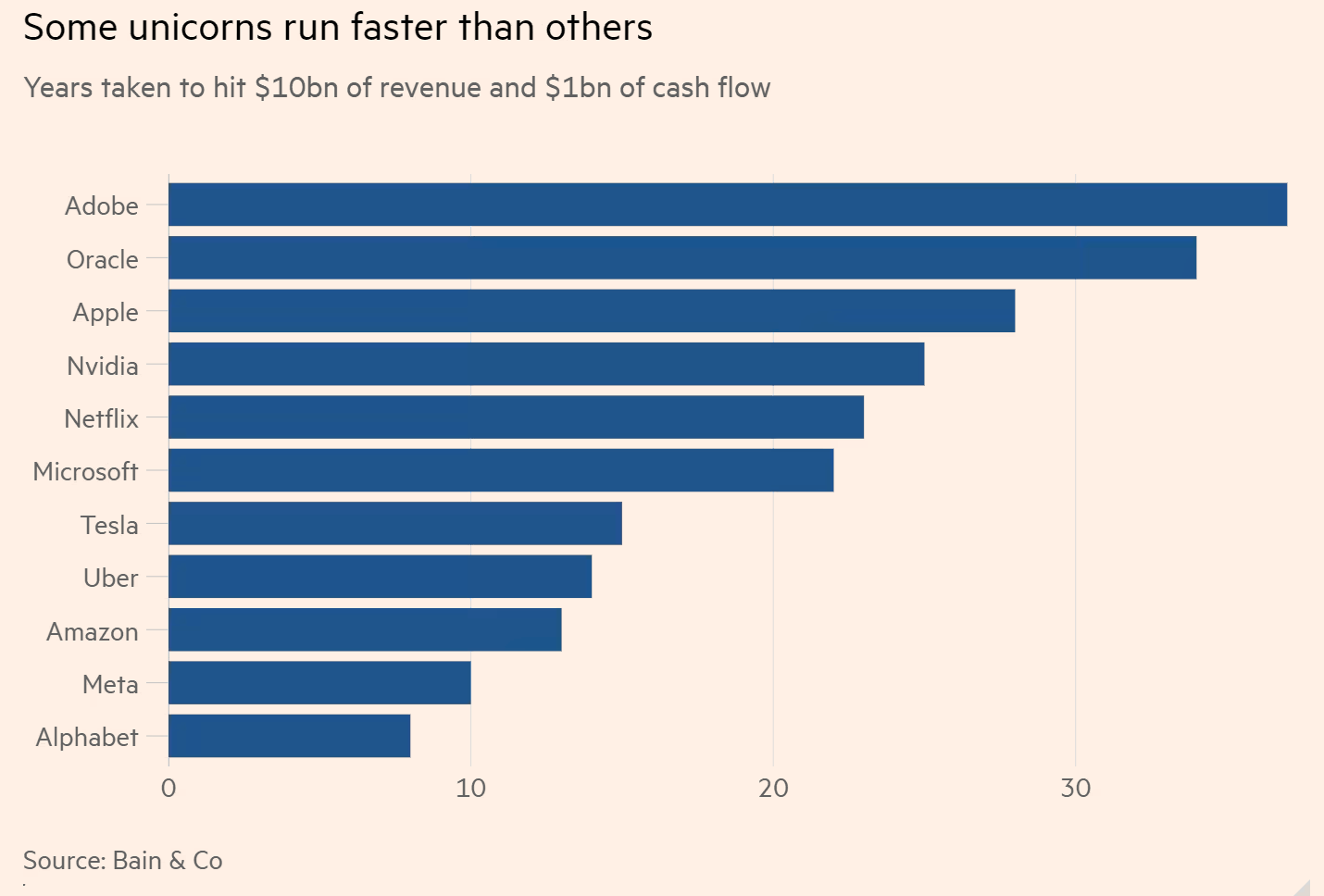

The Financial Times put together this chart with data from Bain & Co. The main gist of the piece in which it's included is that for all the "unicorns" birthed in the past two decades, not many can actually "fly" – at least by one definition, at least not yet:

Cheap money and boosterism made it easier for founders to hit the fabled milestone. But among US companies founded in the past 20 years, only Meta and Uber have transitioned to what consultancy Bain & Company calls a “scale insurgent”, with $10bn in annual revenue and $1bn of operating cash flow. By contrast, the 1990-2003 vintage produced six such insurgents, including Tesla, Amazon.com and Alphabet.

Meta was founded in 2004 – 20 years ago. Uber in 2009 – 15 years ago. FWIW, I believe Airbnb should make the cut this year as they're already there with cash flow and were just under $10B in revenue last year. Of course, it's actually older than Uber – 17 years. SpaceX may make the cut as well, though, of course, it's still a private company. And it's also beyond the 20 year time horizon, having been founded in 2002.

The jumping off point for such a metric is, of course, the most recent OpenAI round. While the company is projecting that it will surpass $10B in revenue next year, cash flow... not so much. Yet! We'll see! The company is 9 years old.