Short & Sweet 📧

A short dispatch today as I’m at the airport and actually writing this on my phone for the first time. Back in office tomorrow.

New MacBook Pros should be dropping shortly (and keeping with the theme of these releases, it seems like at least the existence of the M4 Max chip was leaked — this time by Apple itself). Then in a few hours, Meta and Microsoft earnings.

Update: Sure enough, here are the new MacBook Pros with the M4 Max. And one final 17-minute 'Ternus Note' to close out the updates.

I Think…

📈 Trump Media Rallies as Polls Show Election in Dead Heat – Polymarket nonsense aside, it's wild that the market has a fully legal and liquid way to bet on Trump: shares in Trump Media. While the business is completely upside down, with no signs of turning around, that's obviously not what actually drives the share price – which rose 8.8% yesterday and is now up 324% in the past five weeks as the prospects of a second Trump presidency have improved. By one measure, $DJT is now worth more than Twitter. And it has added billions (on paper) to Trump's wealth. [Bloomberg]

📈 Google’s Strong Earnings Boosted by Cloud Computing Gains – The company beat across the board, with profit jumping a wild (at this scale) 34% to $26.3B for the quarter. That said, free cash flow fell over 20% because... capex hit $13.1B, rising 62% y/y and the assumption is now that such spend will hit $50B for the year – and that is expected to rise again (albeit modestly) next year. Also no surprise: it's not cheap to operate DeepMind in the midst of an AI arms race. But fun: Sundar Pichai noted that over a quarter of all new code written internally is done so by AI. [FT 🔒]

📈 Snap Shares Jump 10% on Profit Beat, Stock Buyback – "Profit beat" is a funny way to frame it, since it was really that they lost less than expected (and, importantly, they were cash flow positive). Still, good news for the (latest) Snap turnaround attempt with (slight) beats across the board. Guidance is a bit weak, but the $500M stock buyback seems to be negating that concern on Wall Street. Most interesting was the continued talk of the new "Simple Snapchat" in testing and likely to launch more broadly in Q1 of next year. While it's framed around simplifying the experience, a big key to that is also putting more ads in more places – simplifying spending for advertisers, I guess! Evan Spiegel noted that it may be a bumpy transition to start though with such a big change. The fact that he's talking about this two quarters early suggests they really expect a bumpy ride next early next year... [CNBC]

I Wrote…

I Link...

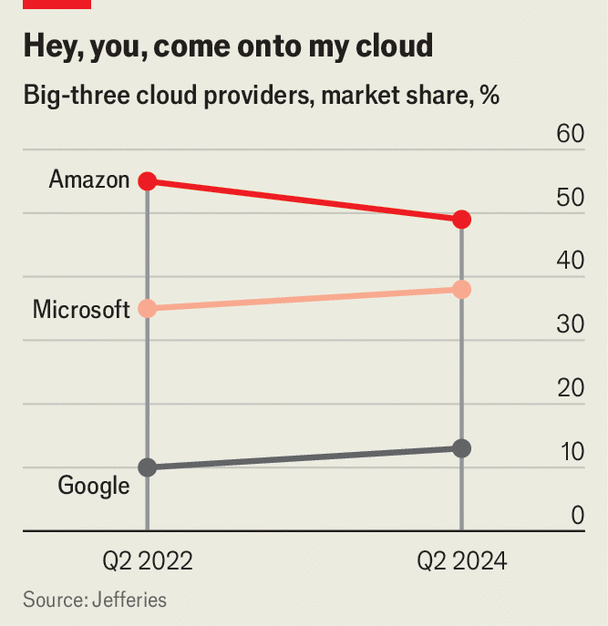

- Some OpenAI investors and board members told The Economist that they'd like to see Microsoft loosen its grip on OpenAI and let it sign cloud deals with, say, Amazon. Um, is this relationship okay? (Seemingly, increasingly, no.) Also, fun comparison to the Medicis. [Economist 🔒]

- xAI at $40B? Nearly double in just a few months? Sure, why not. Notably, we're quickly approaching the price that Elon Musk paid for Twitter. Whereas once upon a time I thought that Tesla would be the company that unified all the various Elon interests, I'm increasingly thinking it will be xAI, which will undoubtedly subsume the 'X' branding if that happens... [WSJ 🔒]

- Disney is going to stream an NFL game set in The Simpsons universe. While the Toy Story one last year seemed cute, this feels awfully forced. Like something that came out of a bad brand synergy meeting. At least they figured out a way for the Cowboys to look more ridiculous? [THR]

- Also: ahead of launching their true Disney um, land with Epic at some point in the future, ESPN Football Island is a new game within Fortnite [Verge]

- Reddit is now profitable. [FT 🔒]

- The other shoe from Tim Cook's recent China visit and new supply chain promises? India is rising fast as an assembly point for iPhones. [Bloomberg]

- And starting with next year's model, it sounds like it could be the key hub to get the flagship models off the ground. [Information 🔒]

I Spy...

The current state of The Cloud™, per Jeffries (from The Economist article linked above)