Big Tech's Wild Market Cap Ride

It is wild how fast stocks can swing – but especially multi-trillion-dollar stocks. Case in point: with NVIDIA's fall from grace the past few sessions (maybe don't bring up Enron in your memos?), Apple is on the verge of overtaking them as the market cap leader once again. Yes, Apple. Not just the AI laggard stock, but the company which spent much of the last year as the AI laughingstock.

As it turns out, perhaps there was some upside in not committing to trillions of dollars in CapEx spend. At least right now.

But it's not just that because it's not just Apple. Google has rocketed higher than the rest of Big Tech over the past several months. Just this past June, under threat of antitrust breakup, I was writing about how badly the market was undervaluing the company.1 That wasn't really even about AI, but everything else they were doing, from Waymo on down. Not only were they a trillion behind Apple at the time, they were about to fall two trillion behind NVIDIA and Microsoft. They were behind Amazon. Hell, they were almost lapped by Meta!

Just a few months later and the tables have turned. Thanks undoubtedly to the notion that not only is Google no longer behind in AI, but they might all of a sudden be ahead, they're also pretty close to overtaking NVIDIA in market cap. And that also puts them close to Apple and thus, close to the crown. Again, in June they were in 4th place in the "race" – and much closer to 5th than 4th, less than $200B ahead of Meta. Now they're $2.3T ahead of Meta.

None of this really matters of course – and these massive swings show just how little all of it matters. (Though don't let these companies tell you they don't care about this at all – of course they do, from Steve Jobs on down, they're all competitive and this is a measuring stick, albeit a sometime arbitrary one.) But it is an interesting gauge to read investor sentiment of these companies over time.

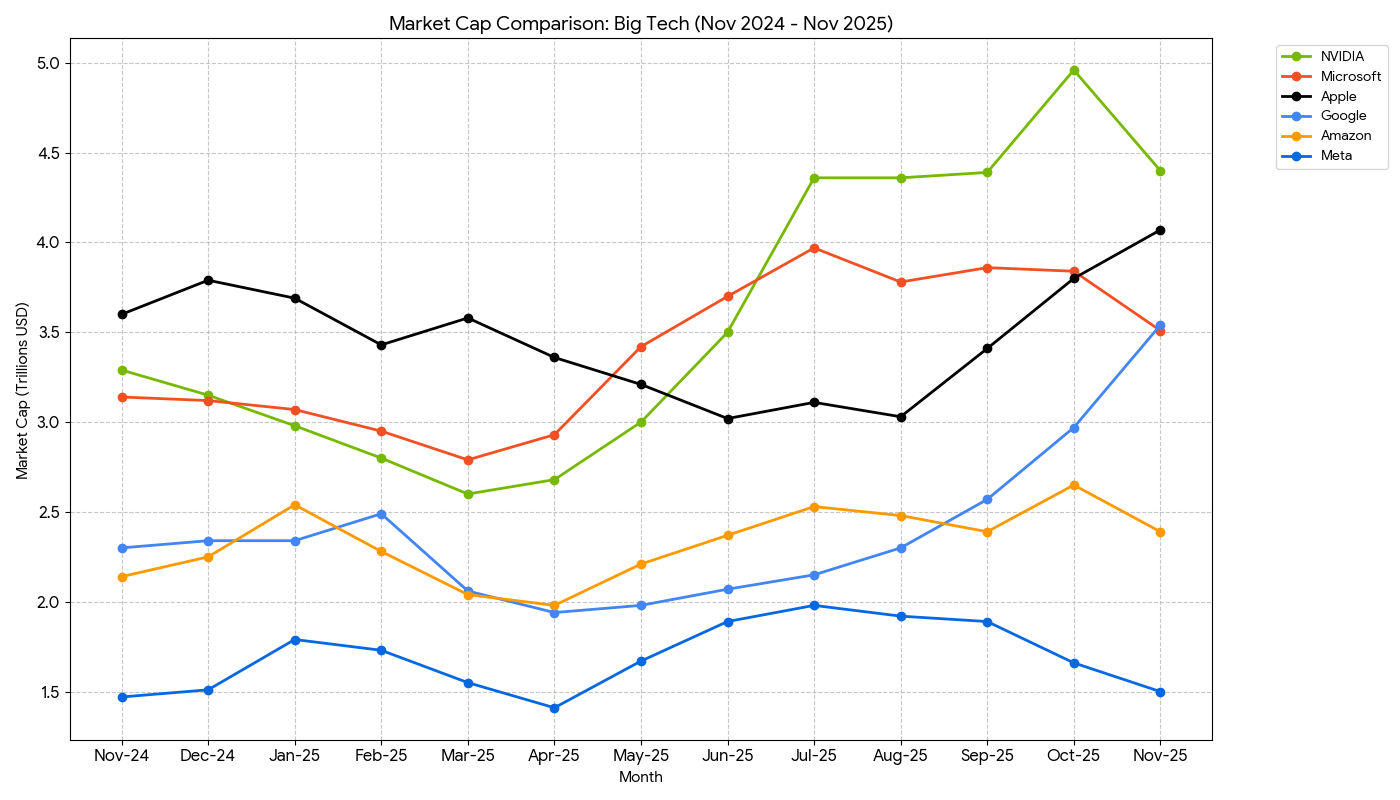

A year ago, Apple was king of the world. After getting passed by not only their old foe Microsoft but also their sometimes foe NVIDIA earlier in the year, they came roaring back. In November 2024, the rankings looked like this:

- Apple: $3.6T

- NVIDIA: $3.3T

- Microsoft: $3.1T

- Google: $2.3T

- Amazon: $2.1T

- Meta: $1.5T

Six months later, in May 2025, it was a different story:

- Microsoft: $3.4T

- Apple: $3.2T

- NVIDIA: $3T

- Amazon: $2.2T

- Google: $2T

- Meta: $1.7T

But by July, just two months later, boom went Microsoft, but even more boom went NVIDIA – both crossed $4T that month, the first companies to ever do so (after Apple had been the first to $1T, $2T, and $3T):

- NVIDIA: $4.4T

- Microsoft: $4T

- Apple: $3.1T

- Amazon: $2.5T

- Google: $2.2T

- Meta: $2T

By October, just three months after that, NVIDIA hit the mythical $5T and was running away:

- NVIDIA: $5T

- Microsoft: $3.8T

- Apple: $3.8T

- Google: $3T

- Amazon: $2.7T

- Meta: $1.7T

And here we are now, mid-day on November 25, 2025:

- NVIDIA: $4.2T

- Apple: $4.1T

- Google: $3.9T

- Microsoft: $3.5T

- Amazon: $2.4T

- Meta: $1.6T

In one year, that's NVIDIA gaining $900B in market cap – but also losing about $900B from their peak. Apple gained $500B after losing about $500B at one point. Microsoft gained $400B but are also about $600B off their highs for the year. Amazon gained $300B and has been the most stable of the group. Meta gained $100B and remained in the six spot the entire year after nearly catching Google just a few months ago, as noted.

Google hasn't held the top market cap spot since a couple brief moments in 2016 (I was there!), but it feels inevitable that they'll retake it again soon. That is unless NVIDIA can find a way to stop sending memos mentioning their business in the same breath as Enron. Stop doing that and they may just have another run or two in them...

1 FWIW, my math at the time suggested Alphabet, then valued at $2T, should be valued closer to $3.5T, and probably higher, if they were giving all of the other businesses beyond Google more of a fair market value. And well, here we are! ↩