Dispatch 018

Happy Thanksgiving Eve. As it turns out, they don't celebrate Thanksgiving in the UK. As such, unlike many of my American brethren, I'll still be here reading and writing tomorrow – for at least part of the day. Then I'll be stuffing myself with family and friends as well. But first, tonight I'm finally going to see Gladiator II. Will report back tomorrow. ⚔️

I Think...

❌ Elon Musk’s Twitter Backers Gain Windfall from xAI Deal – The writing has been on the wall for a while now that this is how Musk would make those who backed the takeover of Twitter, whole. But given the speed at which the massive AI startups are raising, xAI is now already valued higher than Twitter ever was – $50B vs. $44B when Musk made the deal. And with a potential $75B deal on the horizon, it won't be long before that 25% stake in xAI is worth more than Xitter itself is currently. Then the question becomes: at what point does xAI reverse-merge with Xitter to takeover the 'X' name and clean up the cap table? [FT 🔒]

💰 OpenAI Gets New $1.5 billion Investment from SoftBank, Allowing Employees to Sell Shares in a Tender Offer – The first part of the headline is mildly misleading as it's not SoftBank giving the company more money, but instead giving money to the company's employees to buy their shares. This is fairly standard in large deals – especially when there is a party that wanted to buy more in the primary round (i.e. buying shares from the company itself). Sometimes there is a different price on the secondary shares because they are common stock without liquidation preference, but because OpenAI still has such a weird structure, there is instead a sort of "profit preference" hierarchy. And with that structure seemingly on the verge of changing, I'm not sure how much it matters how this secondary is structured. And I'm not sure how much Masa Son cares regardless, as he seemingly wants to go all Michael Saylor on AI. Buy it all, no matter the price. [CNBC]

🎲 Inside Elon Musk’s Quest to Beat OpenAI at Its Own Game – Back to xAI, there's not too much new in this WSJ report about the ongoing war for chips and talent between xAI and OpenAI – including the literal space race, as in, race for space, for AI supercomputers – but one key tidbit: it sounds like a stand-alone, consumer-facing app/service for Grok could come as soon as next month. Right now, it's hard to use Grok – xAI's bot – because it means going into a sub-menu of Xitter. And you have to be a paying Xitter user. Not only is a stand-alone website table stakes in this market, but now a Mac app (and sure, a Windows app later) seems to be needed – certainly as these services aim to perform more agentic tasks. I'm also still waiting for some reporting on what Elon Musk's role alongside the Trump administration is going to mean for OpenAI. Perhaps nothing. But even if it just means more moves in favor of xAI – even if just tangentially by helping the rest of Musk's empire, that seems like something. [WSJ 🔒]

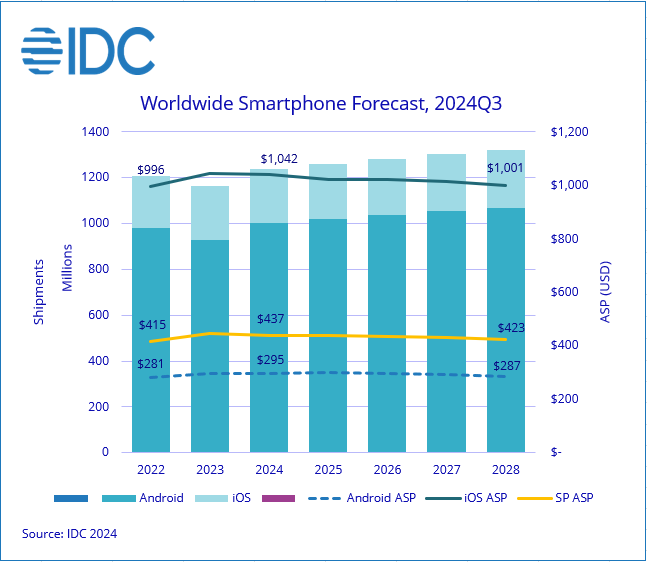

📱 Worldwide Smartphone Market Forecast to Grow 6.2% in 2024 – Some interesting nuggets in the latest IDC report. Notably, that almost all of that growth is coming from Android at the low-end in emerging markets. Given that Apple doesn't viably play at such price points in such markets, and the fact that despite all the hype, AI isn't yet fueling smartphone sales in a major way, it shouldn't be a surprise that iPhone growth is almost non-existent this year. Next year looks better for Apple, perhaps with more actual reasons to upgrade. Also worth noting: IDC doesn't see the foldables market as meaningful yet, but forecast that to change as devices continue to improve. This may mean thinking less 2026 and more 2027 for Apple in that space... [IDC]

I Link...

- The Washington Post lost $77M last year and could lose more this year. It's just an insane amount of money for any business in this line of work to lose. Both things can be true: Jeff Bezos non-endorsement decision was ridiculous (largely in the timing of it) and the company clearly is in need of major changes. [Intelligencer 🔒]

- While the US would like Google to sell off Chrome, the UK would like Apple to alter Safari, at least on the iPhone. Serious question: who will be allowed to own web browsers in the future? [MacRumors]

- Fox (owned by Disney) has extended their contract with Hulu (majority owned by Disney – and soon fully owned once they settle on a price to buy out Comcast). Shocking. [THR]

- Uber using remote gig workers they have been using internally to branch into AI data work for others seems like an interesting tangent... [Bloomberg 🔒]

- With Just Eat's requested delisting being the latest example, the UK really needs to figure out how to make their stock market attractive again. [FT 🔒]

- The most interesting element of Xiaomi working on their own smartphone chips is buried at the bottom here: Qualcomm is a long-time investor in the company. Then again, given the move by the US to curb the best chip technology going to China, this was probably an inevitable break. [Bloomberg 🔒]

- Meanwhile, Huawei finally has phones to run their own OS, HarmonyOS NEXT, the first which apparently doesn't use any code from the open-source side of Android. [CNBC]

- Um, a designer designed a shoe based on the shoe emoji in Apple's emoji set. It's obviously very New Balance – can't imagine why – minus a slash, but fun. $220 fun? That's for you to decide. [Verge]

- As Moana 2 has already started setting box office records in previews, I will start beating my dead horse early to please remember, and perhaps mention the notion of currency inflation when it comes to such records. Moana 2 is going to be massive any way you slice it – humorous that Disney once wanted to make this a direct-to-streaming release, what a misread of demand – let's just use proper context! [THR]

I Note...

♟️ The Greatest Chess Player of All Time Is Bored With Chess – The World Chess Championship started this week and no one cares. Why? Because the best player in the world for the past decade-plus (and perhaps ever), Magnus Carlsen, isn't playing. Why? Because he thinks classical chess is more or less done – in part due to the rise of computer systems which can train players to leave nearly every match ending in a draw. But 'Fischer random chess' – named after, yes, the problematic Bobby Fischer – shifts the dynamic back to skill and creativity, something which world #2, Fabiano Caruana, clearly agrees with as well as he's playing Carlsen in a tournament focused on that game opposite the official one. Of course, Carlsen's interests in breaking the game go literal too: he has a VC-backed startup focused on this new format. [WSJ 🔒]

🏦 He Helped ‘Break’ the Bank of England. Now He May Run the U.S. Treasury. – Fascinating profile of Scott Bessent, Donald Trump's pick – after a lot of internal jockeying – to run Treasury. Honestly, he seems like a pragmatic, interesting choice. His insight and grasp of economics that brought down the Bank of England and later bet on "Abenomics" – both of which earned the Soros funds he help steer, billions (yes, Trump picked a person who long worked for George Soros) – showcase a deep grasp of macroeconomics and a nuanced understanding of ramifications. The latter point feels like it will be key with all the tariff talk – and Bessent frames at least some of it as just that: talk. A way to negotiate. A very Trumpian way to negotiate. Mainly I appreciate his desire to do his own research and read non-stop – going so far as to block of Fridays to do so. Very Buffett-esque of him. [NYT]

I Quote...

"Take it down an octave, make it grungy."

-- Vic Flick, who beyond having perhaps the best name in music, was most famous for having played the guitar in the opening of the early James Bond films. That was his feedback when the producers asked for feedback on the opening music John Barry created for Dr. No.

The result was one of the best-known pieces of music in cinematic history. "That and the brass punched the Bond films to success."

Flick, who also played on The Beatles' film A Hard Day’s Night and was a session guitarist who worked with Jimmy Page and Eric Clapton amongst others, passed away this month at age 87. One way he got to that specific guitar sound for Bond? Putting a pack of cigarettes under the bridge. Senior Service cigarettes to be specific – a British brand named after the Royal Navy. A brand that Ian Fleming had a certain spy enjoy in those early novels – back when Bond was still allowed to smoke cigarettes.

I Spy...

Related to the IDC data above, below is the current forecast for the next few years of smartphone shipments. Perhaps the most interesting element here is that they see the average selling price of the iPhone falling after a long ramp-up past $1,000. There are a lot of variables at play there, but I wouldn't bet against an eventual iPhone 'Ultra' model which jacks that ASP back up, and perhaps an emphasis on RAM upgrades as we go deeper into the world of AI... Also, foldables/flipables will happen at some point, perhaps 2027, per above?