The MoviePass Fraud

There was a time, around six years ago, when I enjoyed few things more than joking at the expense of MoviePass. 'Expense' was the keyword in that equation – it was a business that was so obviously completely upside down that it seemed almost fraudulent. As it turns out...

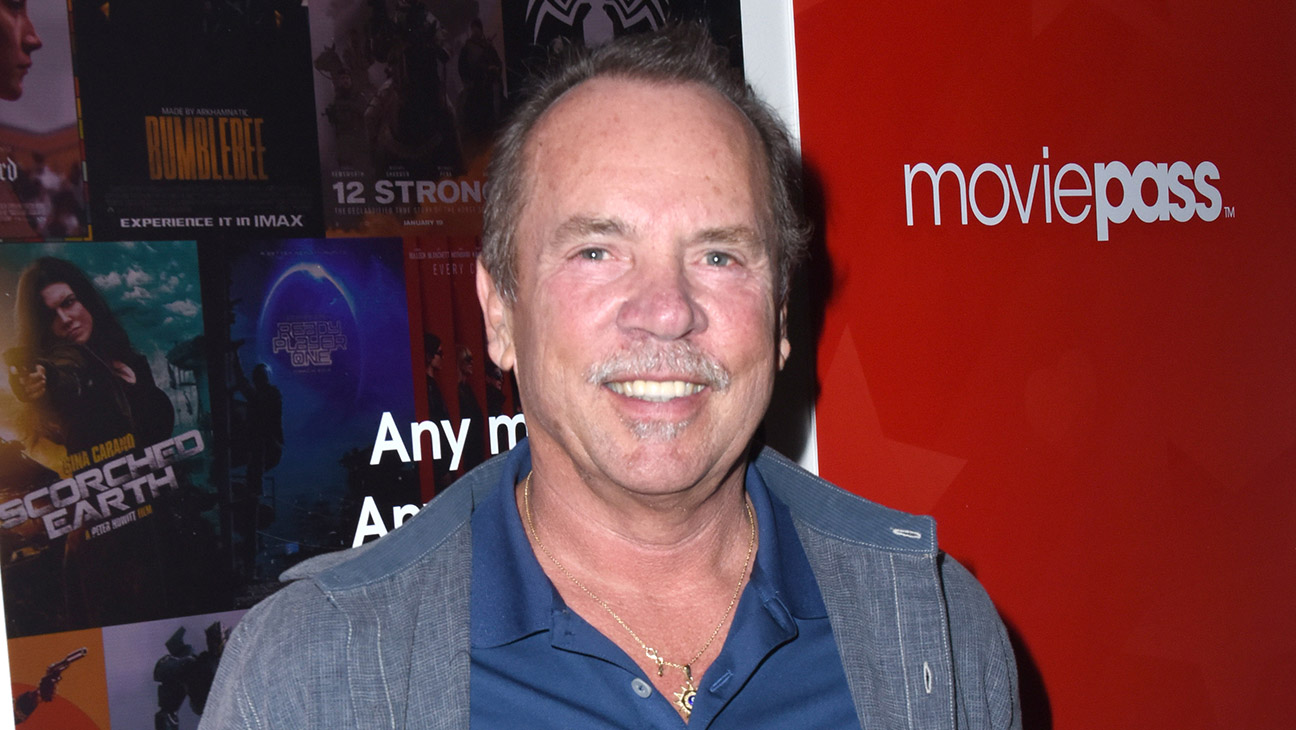

Former MoviePass chief executive Mitch Lowe has pled guilty to a securities fraud charge related to his role in swindling investors about the company’s monthly movie subscription service.

Lowe on Monday entered a plea agreement in which he admitted fault for conspiring to inflate the price of MoviePass’ stock by lying about the profitability and sustainability of the $9.95-per-month unlimited plan in exchange for the dismissal of securities and wire fraud charges. He faces a maximum of five years in prison, with the expectation that he’ll be sentenced to less for assisting with ongoing investigation and cases, plus a fine of up to $250,000 or twice the amount he made off of the alleged scheme.

As I wrote back in March 2018:

They’re paying a price that is too good to be true. Before MoviePass cut the price to $9.99/month, basically no one was signing up. Now that it costs less than the price of a single ticket in many markets, people are signing up. Rocket science, this is not. Unfortunately, it’s not any kind of science. It’s also not any kind of math. At least not any kind that makes sense.

MoviePass says they’re going to make up the difference with data. Basically, they’re trying to get to such a scale that they’ll be able to see trends in moviegoing that they can then market against (and sell some of that data back to Hollywood). They also think they’ll be in a position of power to command a cut at the concession stands. In the end, they’ll get the girl...

[Narrator]: They would not get the girl.

Narrator: they did not get the girl. A big part of the problem was that Lowe and his accomplices in the farce kept making what seemed to be false and certainly were misleading statements. Back to Cho:

In 2022, federal prosecutors brought in federal court in Florida an indictment against Lowe, Ted Farnsworth, CEO of Helios and Matheson Analytics, which acquired MoviePass in 2017, and Khalid Itum, a business development exec for the company. Lowe was accused of making false and misleading statements about MoviePass’ monthly subscription offering, including that it would be profitable or break even on subscription fees alone and that the number of tickets being bought by subscribers was declining, among other things.

Prosecutors alleged that Lowe and Farnsworth knew that MoviePass was losing money as a result of the marketing gimmick meant to drive subscriber growth and that the company was actively preventing users from using the service. Employees were directed to throttle high activity subscribers, according to the indictment.

Worse, at the time, people kept trying to compare it to the venture capital/startup model for scaling. As I wrote in October of 2018:

Instead, MoviePass doused their cash in gasoline and then drove that flaming heap to a match factory. The insane pricing strategy led to the service growing as quickly as possible. And with each new customer came a new undertaker to help them dig their own grave.

This is where people like to compare the model to a more traditional startup. Isn’t this the way many venture-backed companies get off the ground? Well, sort of and no. There have been many startups that have famously flamed out after burning through venture money while effectively trying to sell those proverbial pennies on the dollar with the promise of making it up at scale. But again, MoviePass is no longer venture-backed; their majority owner is a publicly-traded holding company. So they were attempting to do this with public money, not venture money. More importantly, this was a comically extreme version of the playbook described above. This was Helios and Matheson looking at some wildly unprofitable venture-backed startups and saying “hold my beer.”

In a weird way, we were lucky that it happened in 2018, because were it the "meme stock" era, is there any question that MoviePass would have been one? Instead, somehow their foil back then, AMC, ended up in that role alongside GameStop. While the MoviePass guys seem likely to end up in jail.

As bad as Lowe's transgressions were, he allegedly has nothing on Farnsworth. From Gene Maddaus' story on the matter for Variety:

Ted Farnsworth, the former CEO of parent company Helios and Matheson, is scheduled to face a trial on the same charges next March.

Farnsworth, 62, has been in federal custody since August 2023, when his bond was revoked after he allegedly used company funds to pay for a sex worker.

And:

Farnsworth was initially released on a $1 million bond, but prosecutors moved to revoke his release after a series of incidents in 2023.

According to police reports, Farnsworth got into altercations with a former boyfriend in Baldwinsville, N.Y., which resulted in multiple restraining orders. Farnsworth accused the man of choking him and shoving him onto a stairway at their home. The man, 28, accused Farnsworth of damaging his phone and a necklace during a later confrontation at a hotel.

Farnsworth also allegedly paid $147,000 to the man, whom he met on an escort site, taking the funds from a company account. He also bought him a $144,000 Cadillac Escalade with company funds, according to prosecutors. Federal investigators learned that the man did not know what the company was, and had never worked for it. When the two parted ways, Farnsworth falsely accused the man of stealing the Escalade, according to prosecutors.

For those who subscribed to MoviePass back then, this is where your money was going. Allegedly. Well that and buying up up movie tickets the company could not afford. I'm assuming this is already a textbook study, or soon will be.