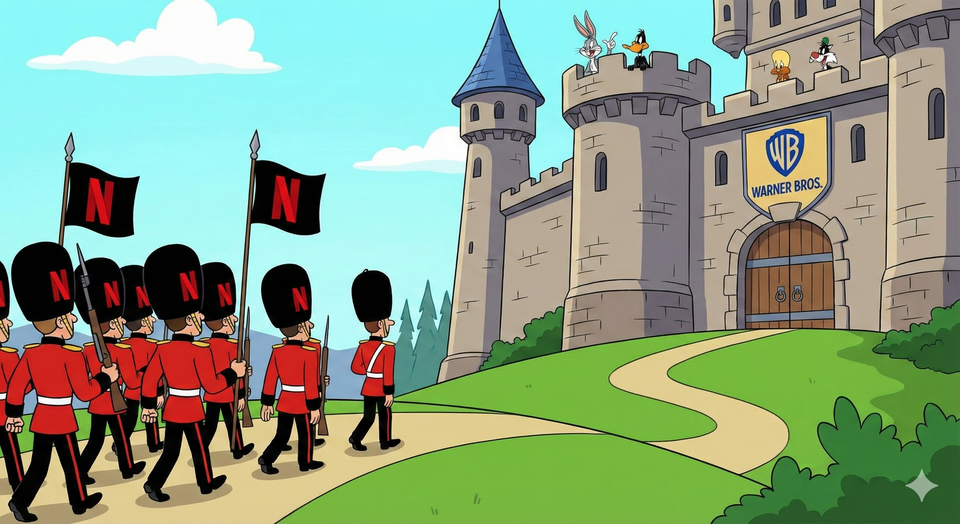

The Albanian Army Closes in on Warner Bros

"Time is a flat circle," Rust Cohle tells investigators in HBO's hit show True Detective. He is, of course, conjuring Nietzsche while waxing poetic about the nature of life coming back around. In that way, it's the perfect encapsulation of the current situation with Warner Bros Discovery and Netflix.

Almost exactly 15 years ago to the day, then-CEO of Time Warner, Jeff Bewkes, gave an interview to The New York Times on the topic of Netflix:

Now many of the companies that make the shows and movies that Netflix delivers to mailboxes, computer screens and televisions companies whose stocks have not enjoyed the same frothy rise, and whose chief executives have not won the same accolades are pushing back, arguing that the company is overhyped, and vowing to charge much more to license their content.

“It’s a little bit like, is the Albanian army going to take over the world?” said Jeffrey L. Bewkes, the chief executive of Time Warner, in an interview last week. “I don’t think so.”

Maybe not the entire world (yet), but Bewkes' (former) world in the form of Warner Bros? Yes. As Lucas Shaw and Michelle F Davis scoop for Bloomberg:

Warner Bros. Discovery has entered exclusive negotiations to sell its film and TV studios and HBO Max streaming service to Netflix, according to people familiar with the discussions.

Netflix is offering a $5 billion breakup fee if regulators don’t approve the deal, said the people, who asked to not be identified because the discussions are private. The two companies could announce a deal as soon as in the coming days, assuming talks don’t fall apart, the people said. The move suggests Netflix has pulled ahead of Paramount Skydance and Comcast, who were also competing for the asset.

[Update: Netflix has now formally announced the deal, see below]

This wild turn of events is far from complete, of course. And, it's so contentious right now that it may very well never be completed. This is a deal with such big ramifications that it has many players up in arms, from Washington to Hollywood. But none more so than Paramount, as the first suitor now scorned.

In a way, I'm reminded of when Warner Bros Discovery was scorned by the NBA in favor of a deal with Amazon. Or when other bidders for Paramount felt scorned when the company went with Skydance. It all comes back around...

One of my predictions heading into 2025 was that someone would buy Warner Bros Discovery. I even guessed that Paramount might be interested in further bulking up post-Skydance deal. While a tech company was always going to be a wild card, to me, Apple always seemed like the most logical bidder given both their size, (relatively weak) position with Apple TV+,1 and the fact that Eddy Cue had tried once before to buy HBO.2 As the most entertainment pure-player in tech, Netflix always lingered, but this type of deal almost seemed like an anti-Netflix deal, something they would have seemingly never done in the past.

But as I know better than perhaps anyone, Netflix loves to say they'll never do something, only to change their minds a few years later and go all-in on whatever the previously ridiculed idea was. In this way, they're like Apple, actually. As I wrote coming up on 15 years ago now:

Netflix has confirmed that they intend to pay for House of Cards a new show being produced by David Fincher (yes, he of Fight Club, The Social Network, etc) and starring Kevin Spacey (yes, he of The Usual Suspects, American Beauty, etc). Netflix is not paying for the full production of it, but instead they’re paying for the first-rights access to air it. In other words, they get the first “window” to show it to viewers.

And while the company is saying that this isn’t a shift in strategy, it could end up being potentially much more than that.

Up until now, Netflix has not had content in this first window. Instead, they’ve focused on the second or third or even fourth window. That is, they’ve shown content after it’s in theaters or on television for its initial run. And sometimes they don’t get content until after it’s been in theaters and then on television for quite some time. This catalog of content has been the service’s bread and butter.

But with House of Cards, the game changes. For the first time, they’re going to get people signing up to Netflix to get first access to content. And if it’s as good as the talent behind it suggests, they might get a lot of people signing up for that very reason.

And if that’s the case, they’ll be doing a lot more of these deals. And that would effectively make them a premium cable television channel — like HBO or Showtime. But they’ll be one with thousands more pieces of content for a lower monthly price. And they’ll be one not burdened by any artificial show times. Most importantly, they’ll be one not burdened by the cable television model — at all.

Narrator: it was, as it turns out, a shift in strategy. And yes, much more.

Netflix was never going to do ads – until they did ads. Netflix was never going to do live – until they did live. Tangential to that, Netflix was never going to do sports – until they did sports. And as I also predicted last year, Netflix was never going to change their mind about theatrical distribution – until they inevitably did.

This deal would all-but ensure such a backtrack becomes reality. I think it would have happened regardless at some point (and still probably will even if this deal doesn't happen), and was already happening in some ways, but this just speeds up the process and the rationale for going against such a seemingly adamant stance.

But the bigger shift will be the deal for WBD itself. Assuming the reports are accurate that Netflix's bid is the largest – does this really mean that their offer for just the studio + streamer is bigger than Paramount's offer for the entire company?! – this deal will be well north of $50B. Perhaps as high as $75B. Perhaps more! And apparently almost entirely in cash. [See: update below]

Netflix undoubtedly will take on debt to make that payment, and so that will be a fun return to some old arguments as well. Remember when everyone was up-in-arms about the amount of debt Netflix was leveraging to produce their content? No one talks about that anymore as it ended up being a smart lever to win streaming. And winning streaming has allowed them to do this deal.

At the same time, that position will also give them headaches for this deal. Given Netflix's streaming stature, Paramount has focused in on making the case as to why the DoJ will never approve such a deal (and they may go hostile, driving those points home). And several regulators are already echoing as much – including, it seems, the US AG's office. This is ramping fast, with many scorned lover letters having apparently been sent. And now legal threats are in play too...

On the flip side, Paramount Skydance says any deal they did with WBD could sail through – even though they just did a smaller deal (for Paramount itself) which was held up for months by regulators. Implied in this, of course, is that the Ellison family now has their "in" with President Trump to make such a deal happen faster this time. (And naturally, to pressure the other one, perhaps.) Did, say, cancelling a certain late night show, and other curious concessions grease those wheels? Well, at the very least, they couldn't have hurt!

Oh yeah, and then there's Comcast. Poor Comcast. Big enough to make a bid but not big enough to be taken seriously, even though they arguably need Warner Bros assets the most. Perhaps they could team up with Paramount?

Netflix, for their part,3 will argue that streaming services aren't the actual market for regulators to worry about here, but rather the broader "time spent" category for eyeballs. Certainly, this includes YouTube, the only video service larger than Netflix. But also increasingly Spotify, TikTok, and other tangential networks. In this way, it will be similar to the (winning) argument that Meta made against the FTC in their antitrust case. Forget about social networks, this is about the future of time spent. And it even has parallels with the Google antitrust case which saw the search giant avoid major remedies because well, think to the future: AI.

Netflix's future is trying to grow from a $500B company into a $1T company – the first "media" company to do so. Would anyone bet against them? I certainly wouldn't. I've been quite vocal about this for years and years. They're simply the smartest and most forward-thinking company that bridges tech and entertainment. As we enter the brave new world of AI, they'll be right there too.

To that end, don't be shocked if while everyone is up-in-arms in Hollywood today about this deal, worried that it will be the end of yet another major studio and perhaps the entire system, that they end up viewing Netflix as a sort of savior in the future when AI comes knocking on everyones' door. Just another prediction I'll throw out there: This deal, if it happens (very much not a sure thing), could end up being very good for Hollywood. It's an industry that has long needed the biggest kick in the ass. And Netflix kicks ass.

So we can all look back on the "Albanian Army" comment now and laugh. Because they're here. At the gates.

One more thing: Back to the concept of time being a flat circle... some may recall another famous/infamous quote between Netflix and Warners. In 2013, then-Chief Content Officer of Netflix Ted Sarandos quipped that the company's goal was "to become HBO faster than HBO can become us." Sarandos, now, of course (co) CEO of Netflix, has gone on to note how he regretted the comment because it was sort of comically limited in scope relative to what Netflix would go on to become. But it sure takes on a different light with this news! In a way, it would fulfill the goal. Netflix would become HBO...

Update: Netflix has now confirmed the deal, a "cash and stock transaction is valued at $27.75 per WBD share (subject to a collar as detailed below), with a total enterprise value of approximately $82.7 billion (equity value of $72.0 billion)."

Now the fun begins. Per the release, it sounds like they're not anticipating these deal closing before Q3 2026 at the earliest, and it could be quite a bit longer depending on the reviews, challenges, etc... Bust out that popcorn.

Update December 6, 2025: Some further thoughts...

Update December 9, 2025: Just how legit are Netflix's movie theater claims...

Update December 15, 2025: And more thoughts still on on Netflix's grander plans...

1 Yes, now confusingly just called 'Apple TV'. ↩

2 He couldn't figure out a deal with... Jeff Bewkes! ↩

3 They are also arguing that this deal will be good for consumers – still a key tenant of current antitrust thinking – because a Netflix/HBO Max combo/bundle will bring ever-increasing streaming subscription costs down. Presumably by removing one player from the market! ↩