Netflix Calls Paramount's Bluff

The most obvious reference would be to The Godfather. So much so that I almost can't believe neither Netflix nor Warner Bros made it in their comments around the re-opening of discussions with Paramount. There are just so many to choose from! Even beyond any number of Corleone family quotes, there's the whole horses-head-in-the-bed bit. And so many others which are especially top of mind right now with the passing of Robert Duvall. Yes, yes, an activist, Ancora Holdings, already sort of played that hand. But come on. I mean, Paramount now literally has to make an offer that WBD cannot refuse!

Still, for some reason my mind is drawn towards another Paramount release: Willy Wonka & the Chocolate Factory. At the end of that film – 55 year spoiler alert – Wonka's demeanor suddenly switches from one of seeming disinterest in Charlie and Grandpa Joe as they're leaving, to one of anger. As Grandpa Joe pushes for the free chocolate Charlie was supposed to receive, Wonka points out the contract they signed. "It's all there, black and white, clear as crystal! You stole fizzy lifting drinks! You bumped into the ceiling which now has to be washed and sterilized, so you get nothing! You lose! Good day, sir!"

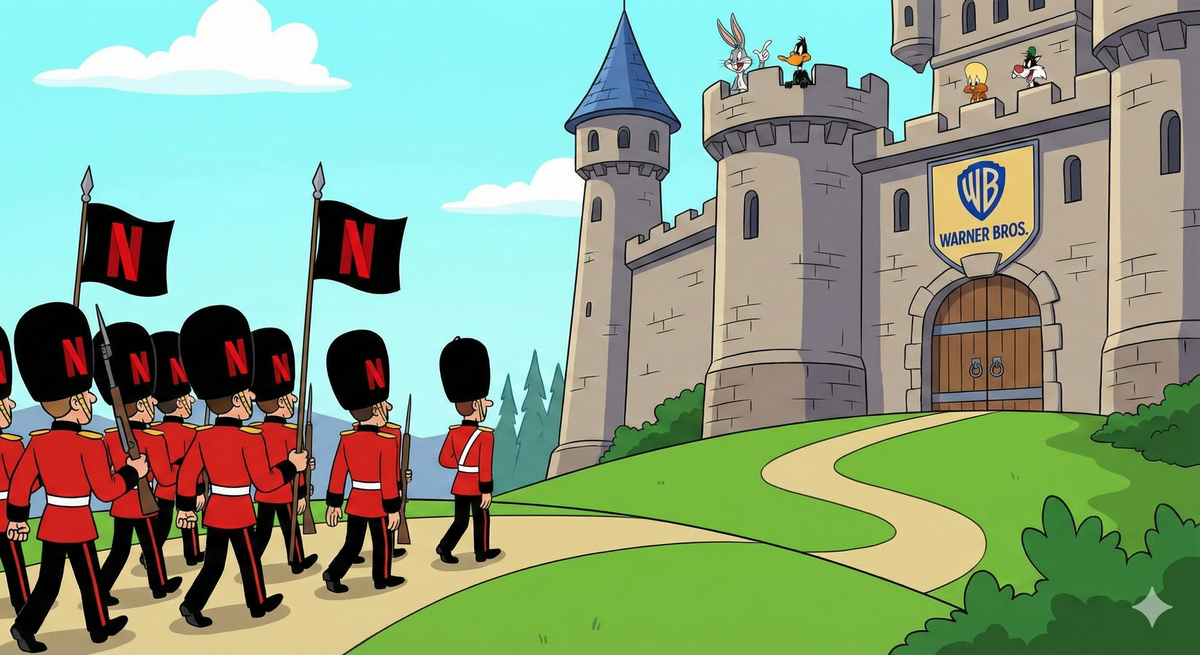

As Paramount has relentlessly pushed from all angles to suggest that they actually should have been the winners of the Warner Bros sweepstakes, Netflix has just sort of kept going. Making the case to Washington (and Hollywood) about the deal, but largely ignoring the "loser". Until today.

“Throughout the robust and highly competitive strategic review process, Netflix has consistently taken a constructive, responsive approach with WBD, in stark contrast to Paramount Skydance (PSKY),” Netflix said in a statement. “While we are confident that our transaction provides superior value and certainty, we recognize the ongoing distraction for WBD stockholders and the broader entertainment industry caused by PSKY’s antics.”

"Distraction" and "antics" are just the start.

“Accordingly, we granted WBD a narrow seven-day waiver of certain obligations under our merger agreement to allow them to engage with PSKY to fully and finally resolve this matter,” the streamer continued. “This does not change the fact that we have the only signed, board-recommended agreement with WBD, and ours is the only certain path to delivering value to WBD’s stockholders.”

This is Wonka getting out the magnifying glass to read the fine print...

Netflix reiterated that its deal with Warner Bros. would “deliver more choice and greater value to audiences worldwide with expanded access to exceptional films and series – both at home and in theaters.”

It also said the deal “is centered on growth, opportunity, and a reinforced commitment to creating world-class films and television – not consolidation and layoffs” and would expand production capacity, increase its investment in original content and create jobs.

In other words, this is Netflix calling Paramount's bluff. First and foremost, the fact that they keep floating the notion of raising their bid, without actually doing so. But also, the notion that they keep trying to spin a narrative that their deal, even without the price change, is better. Netflix has a pretty clear counter argument to that. It's a bit more than one word, but to boil it down: bullshit.

At the same time, Netflix blasted Paramount, arguing it has “repeatedly mischaracterized the regulatory review process by suggesting its proposal will sail through, misleading WBD stockholders about the real risk of their regulatory challenges around the world.” For example, the company noted that it received clearance from foreign investment authorities in Germany on Jan. 27 — the same day as Paramount.

It also said that the foreign funding backing Paramount-Skydance’s bid is “already raising serious national security concerns” and that it expects the Committee on Foreign Investment in the United States (CFIUS), Team Telecom in the U.S. and European authorities to scrutinize Paramount’s backing from Middle Eastern investors.

“In reality, PSKY is far from obtaining all of the regulatory clearances required,” the company said. “Enforcers will focus on the impact of PSKY’s proposal on competition, job losses, reduced output, and downward pressure on wages for film and television workers.”

Netflix also warned that the Paramount offer would create “significant horizontal overlaps” that will concern antitrust enforcers, including combining two of the five major Hollywood studios, two major theatrical distribution channels, two of the major TV studios, two major news networks and two major sports distributors.

Again, this reads like Wonka unloading on poor Grandpa Joe! And it keeps going:

Additionally, the streamer argued that Ellison’s “aggressive financing package, rapid deleveraging plans, and performance track record pose tremendous risks to both the completion of their proposed deal and the industry” and that Paramount would be over-leveraged with approximately $84 billion in debt and a roughly 7 times leverage ratio.

In order to hit the midpoint of its deleveraging targets, Netflix said it would need to realize roughly $16 billion of cost savings — far in excess of its previously disclosed $6 billion synergy figure — through “greater, even deeper job cuts that would irreparably harm the entertainment industry.” It added that Paramount is undershooting its guidance for 2026 adjusted operating income by 15%, which could mean even more cost cuts.

“This extraordinary execution risk and track record of operational underperformance could impact PSKY’s ability to fund and close a transaction,” the company concluded. “A business plan that is dependent upon $16 billion in cost savings should be an unmistakable red flag for regulators, policymakers, union leaders and creatives.”

In other words, Netflix to Paramount: put up (more money) or shut up. Netflix to WBD shareholders: even if they happen to put up a couple more bucks per share, you'd be crazy to go with their offer. We're so confident in this, that we're giving them a week to come back with something. After that, no more bullshit, let's get this deal done.

The problem for Netflix, of course, is that investors – at least those who own huge chunks of WBD shares – undoubtedly only care about the bottom-line here in this deal. If Paramount moves to $31 or $32 or $33/share, Netflix is likely going to have to counter with something beyond words – no matter how compelling those words may be! It's just math and investors are for the most part, stupid. They need the math to be done for them.

But, to a point sort of tangential to Netflix's own points, there might be a reason why Paramount hasn't yet raised their offer: because they're already insanely levered here. This would be a relatively small company buying a much larger one, versus the Netflix situation, which is the opposite. Both are using debt, of course. But only one needs a personal backstop from one of the richest men in the world – and the father of the CEO of the acquiring company – on that debt. It's, um, strange. And it doesn't really speak to an easy path forward here for the newly combined companies. Netflix and Warner Bros though? It may or may not be a success, but the path is far more straightforward.

Perhaps Paramount's play was to push this to the breaking point before raising their bid and trying to run away with the bag. Or maybe Netflix has one more trick up their sleeve as well. Either way, the next week will be fun! Will someone wake up with a horse head in the bed? Or are we about to go for a ride in the glass elevator? All options are back on the table thanks to a clearly pissed off Netflix, who got sick of WBD's meek attempts to tell Paramount to piss off.

Thanks for reading, if you enjoyed this, perhaps:

🍺 Buy Me a Pint

🍺🍺 Buy Me 2 Pints (a month)

🍻 Buy Me 20 Pints (a year)