Signal: Streaming Time is a Flat Circle 📧

Earlier today, on the back of the reporting that Netflix was closing in on a deal with Warner Bros Discovery, I wrote up some thoughts. It's obviously a massive deal with ramifications both for entertainment and tech. Just a few hours later, Netflix confirmed the $82.7B cash-and-stock deal. Mind you, that's just for the Warner Bros studio and HBO Max streaming service, the cable channel assets will still be spun-out ahead of this deal closing. So yeah, it's a big price. And certainly a deal unlike any Netflix has done before.

While investors clearly dislike the deal (Netflix's stock has been down between 3% and 5% on a day the overall market is up), it could make quite a bit of sense – if it actually gets completed. Netflix is going to have a hell of a fight on their hands on a few fronts there. Including with Hollywood in general, which clearly does not want to lose another studio, let alone such a historic one, to the hands of tech. But I also don't think it will end up being a bad thing for that industry in the long run. Which is just an impossible thing to hear right now, but it's an industry on the verge of everything being thrown into disarray with AI.

For now, I'll just tout my predictions from last year, both that WBD would be acquired, but also that Netflix would eventually backtrack on their theatrical release stance. Both look good right now. But again, there's a long way to go here. Get the popcorn ready.

The Inner Ring...

Thoughts On...

🌍 Meta Not Investing in Yann LeCun's "World Model" Startup – As expected, while everyone was saying the right things around his exit – how the two sides would continue to work together, yadda, yadda – it sure sounds like Meta won't be investing in his new startup because he doesn't want them investing in his new startup. In fact, he seemingly doesn't want to have anything to do with Silicon Valley anymore – or at least, for now: "Silicon Valley is completely hypnotized by generative models. So you have to do this kind of work outside of the Valley, in Paris." Hypnotized to the point of spending $15B or so to reboot your AI work with offering billion-dollar comp packages, perhaps? He also seemingly confirmed that Meta wasn't interested in his new work – will that end up a mistake? Plenty of others clearly are! [Bloomberg 🔒]

🇪🇺 The EU Strikes Back – While it has seemed like regulators in Europe were taking their foot off the gas a bit with both their own regime change, as well as the situation with the Trump administration, they're clearly still finding new and interesting ways to go after Big Tech. I actually think the probe into Meta over the use of AI within WhatsApp is the type of thing that should be looked into – not because it's Meta, but because all of the scaled players have crazy advantages when it comes to distribution of their AI tools. It's probably what should have been more of the focus in the Google antitrust remedies, but instead the rise of AI ended up helping Google (as it is naturally disrupting Search). Note that this has nothing to do with the DMA and is simply a probe for now – the EU loves to launch probes. Which is still a problem because some seem like completely political wastes of time (or worse) while others seem warranted. On a tangential note, I will admit that I do find it somewhat humorous that the EU is fining Xitter $140M – what characters. [FT 🔒]

🐭 Disney's Two-Mouse Race – It has felt for a while like the battle to succeed Bob Iger as Disney CEO was down to two candidates: Josh D'Amaro and Dana Walden and this reporting all-but-confirms it. Further, it has also at least looked from the outside like D'Amaro has pulled ahead over the past year or so. While it's undoubtedly unfair to use Walden's friendship with Kamala Harris as a data point here, it also probably has to be taken into account because a certain President of the United States will take it into account. And the flip side was also true: had Harris won, such a relationship undoubtedly would have boosted Walden. So it's bad timing/luck. And the Jimmy Kimmel debacle probably doesn't help either. But one new question: does the Netflix/Warner deal change the equation at all? Presumably not, but Walden's role will be even more vital, so could Disney convince her to stay even if not in the top job? Co-CEOs has to be out of the question, right? Even though it's working for Netflix! Sort of wild that 2026 could see new leaders atop two of the major studios... [WSJ 🔒]

💸 Michael Burry's 1999 – A fun read where he goes into his backstory around the Dot Com Bubble. Personally, I had no idea that he was sort of casually writing about stocks on the side of his work as a resident physician at Stanford Hospital. His favorite topic? Like any good blogger: Apple. "Great companies can be missed for a long period of time. Apple was one of them. At the time, I liked where it sat in the culture of creative computing, with a very proprietary angle and a knack for minor hits and long draughts. Plus they had just released their Blueberry, Strawberry, Tangerine, Grape, and Lime iMacs. And I thought, yep, this is the reason to own Apple." He was not wrong. Though perhaps early. See also: his recent podcast with Big Short author Michael Lewis where he talks through his (more nuanced) thinking around his recent short positions on Palantir and NVIDIA. Basically, he simply thinks the AI Bubble is going to burst within the next couple years. [Cassandra Unchained]

I Wrote...

I Quote...

"We as a company try to manage as responsibly as we can. And then I think there are some players who are YOLO-ing."

– Dario Amodei speaking at the New York Times DealBook Summit about some unnamed competitors, at least one of which is pretty clearly the place he used to work: OpenAI. This is basically the point I was making in writing "AGI or Bust". Great risk, great reward, and all that. But Anthropic's more prudent approach could pay off depending on the markets...

In the same talk, Amodei also said he thinks scaling (LLMs) will get us to AGI eventually (i.e. he doesn't think we need new models – which makes sense for him to say that since, at least as far as anyone knows, Anthropic isn't working on other models). And yes, he also had a fun quote about how they don't do "Code Reds" – like that other company he dare not name.

Asides...

- Speaking of... is it more like "Code Red for thee, not for me" over at OpenAI with Sam Altman exploring building a um, SpaceX competitor?! [WSJ 🔒]

- To be fair, it seems like he was discussing this months ago, before the actual Code Red – though perhaps not before the Code Orange! Regardless, it adds to the narrative that OpenAI perhaps needs to focus a bit more from the top down...

- OTOH, there is a world where being able to launch things into space is a huge strategic advantage in AI, if say, you need to launch data centers in to space...

- One more thing: an aside in that story was that the OpenAI/NVIDIA deal is still not finalized apparently. Um...

- How upset was Masa Son that he had to sell SoftBank's NVIDIA's shares in order to fund his continued partnership with OpenAI? He was apparently "crying" about it. Which just raises the question how he felt after the last sale that literally ended up costing him hundreds of billions. [CNBC]

- Happy 3rd birthday ChatGPT. Amazing how much has changed. [TechCrunch]

- Add The New York Times and The Chicago Tribune to the growing list of media (and non-media) companies suing Perplexity. [NYT]

- Meanwhile, some news publishers have signed deals with Meta to use their content within AI products. Unlike the last 35 times, Charlie Brown is going to totally kick the football this time. Lucy will not pull it at the last minute. Not a chance... [Axios]

- While I just spent much of the day praising Netflix, I will say that killing off the ability to "cast" content to TVs is pretty annoying. I use this quite often at say, hotels. But above all else, Netflix wants to be in control... [Verge]

- Jumping to a scene in any movie on a Fire TV by describing it to Alexa seems like a fun showcase of their AI capabilities, but it is just a party trick? Who wants to jump to an exact scene of a movie that often? Isn't that what YouTube is for? [THR]

I Spy...

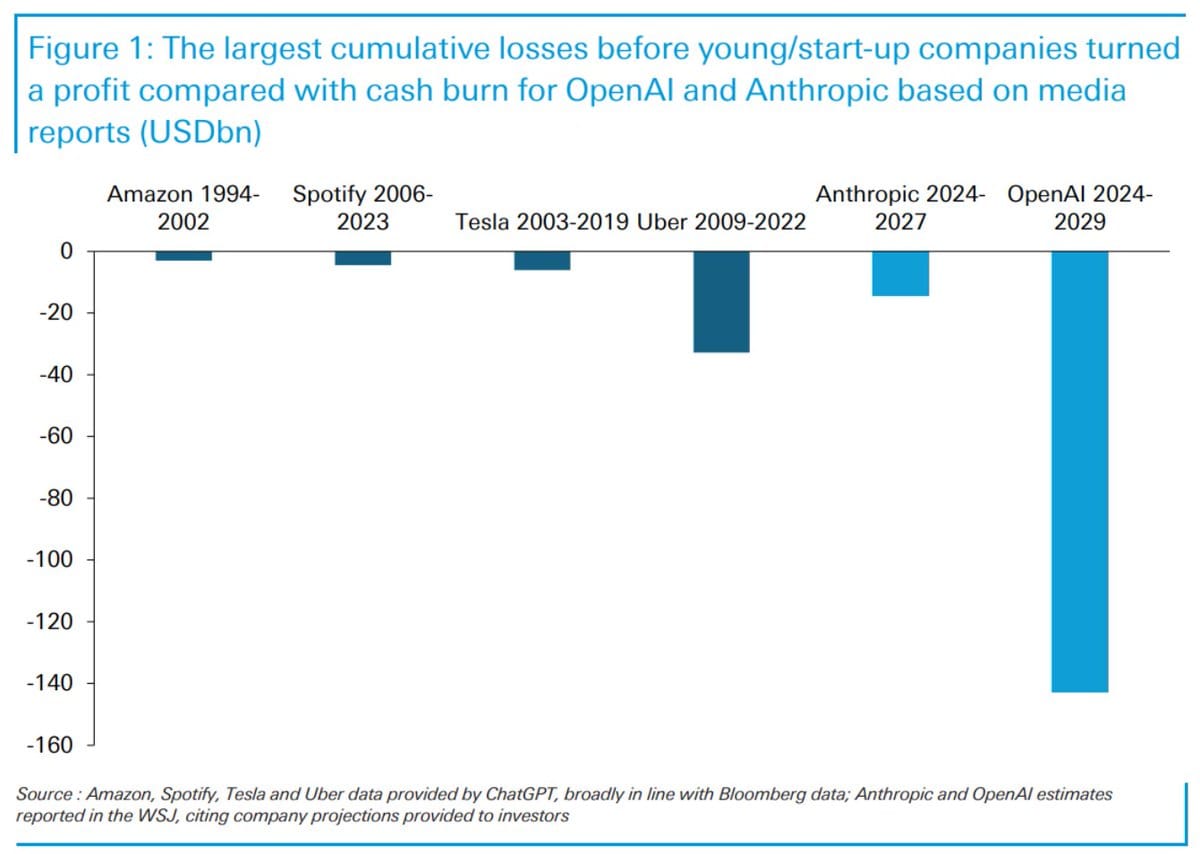

With all the talk of the AI Bubble, you often hear OpenAI's spend talked about in context of what both Uber spent to get to profitability and before that, Amazon. Well, Jim Reid and Deutsche Bank actually charted it out. And... wow. Code Red indeed.