There is No VR Market, There is a (Small) Meta Quest Market

Reports don't get much more damning than this. For seemingly the 10th year in a row, there still really isn't a VR market.1 While there had been a lot of hope leading up to Apple's entry with the Vision Pro and Meta's continued quest to make the market with the Quest headsets, the overall market is now shrinking again:

Global virtual reality (VR) headset shipments fell 12% YoY in 2024, the market’s third consecutive year of declines, according to the latest update from Counterpoint’s Global XR (AR/VR) Headset Model Tracker. In Q4 2024, the shipments fell 5% YoY. Hardware limitations, lack of compelling VR content and usage scenarios, and decreased consumer engagement continued to impact the market. However, demand from the enterprise market, though relatively limited in size, remained more resilient, particularly in large-scale immersive Location-Based Entertainment (LBE), education, healthcare and military.

In English: while Q4 – the holiday quarter – was slightly better than the overall year, it too was still down. And it all would have been more dire were it not for some level of enterprise adoption of such devices. That included with Apple – something the company has clearly been trying to pivot towards a bit – and notably, Pico, the Chinese player in the space which actually saw its enterprise shipments overtake the consumer headsets.

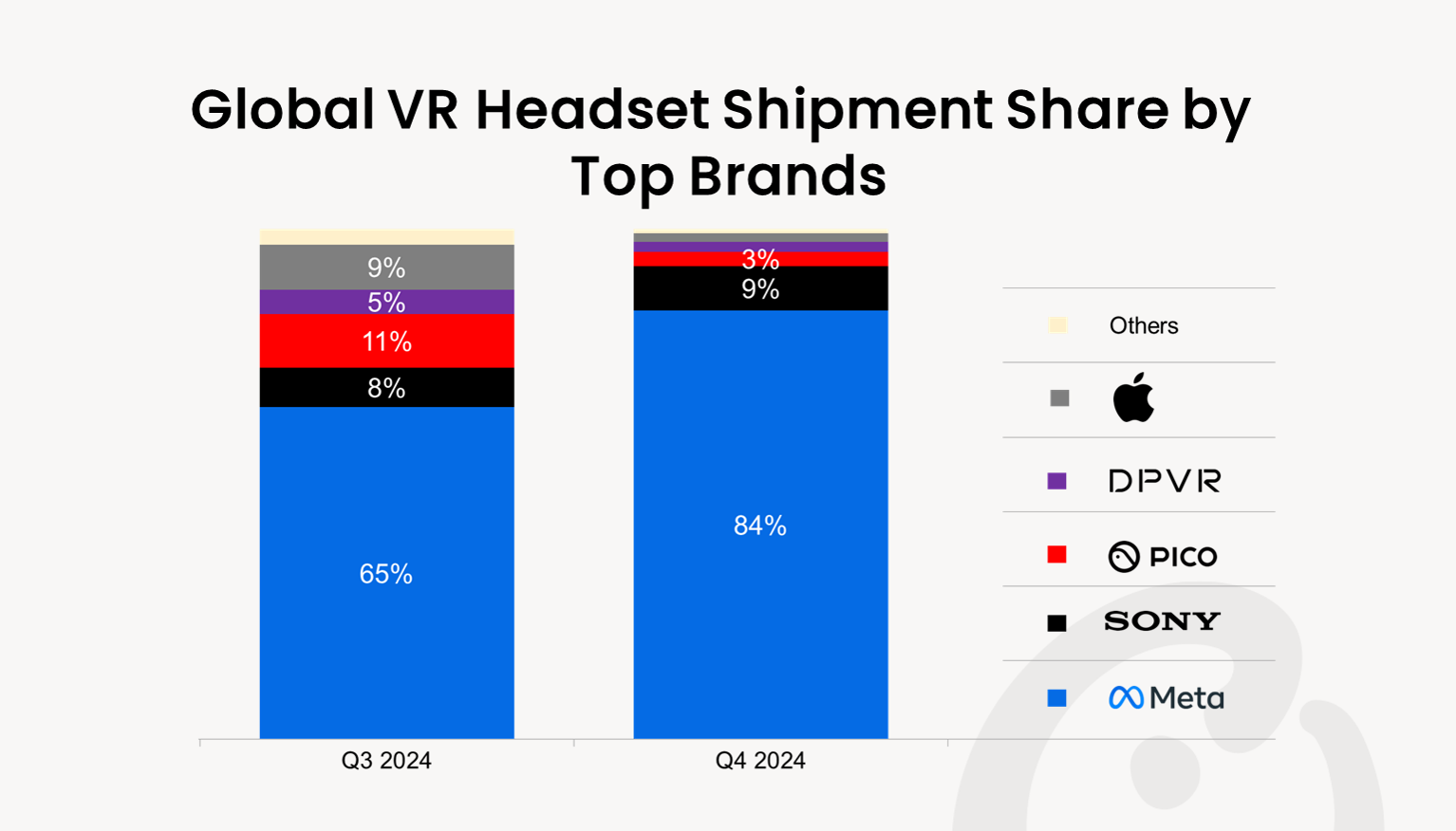

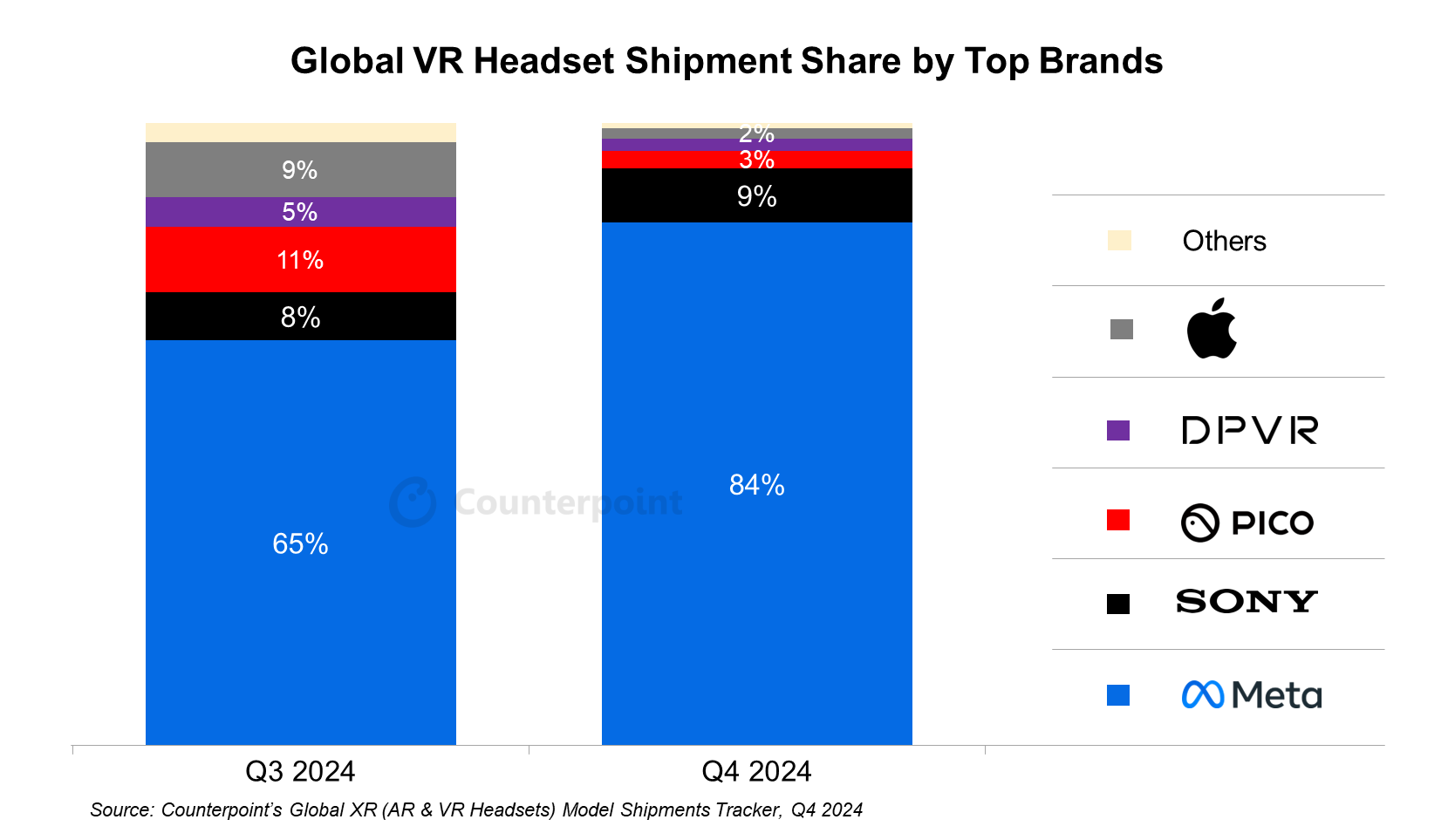

Meta continued to dominate the global VR headset market in 2024 with a share of 77%. In Q4 2024, Meta’s market share rose to 84% primarily due to the launch of the more affordable Quest 3S headset. Sony’s PSVR2 shipment share surged to 9% in Q4 2024, fuelled by aggressive promotions and discounts during the Black Friday and Christmas sales. Apple’s Vision Pro shipments saw a steep 43% QoQ decline in Q4 2024, reflecting a slowdown after the initial market hype. In Q4, Apple expanded the Vision Pro’s availability to new markets, including South Korea, UAE and Taiwan, which helped partially offset the overall decline. The device’s enterprise sales also saw an uptick.

Yeah, I mean as the chart (below) drives home, if there is any sort of VR market right now, it's really just a Meta Quest market. 84% of market share is getting up to Google Search/Chrome levels of dominance. The only player they didn't take share from in Q4 was Sony, which saw its year-on-year market share rise by a whole 1% thanks to those deep discounts – because the PSVR itself is seemingly a disaster. Apple went from 9% share down to a measly 2% in Q4 – and again, that's of a shrinking overall pie.

It's worth noting that this is only for the VR headset market, which yes, includes the Vision Pro, even though Apple would like us to believe it's something entirely different. It does not include the AR smartglasses market, where business is booming thanks to who else? Meta.

Shipments in that market were up 210% year on year – undoubtedly from a tiny base, but still, growth is good! And while Meta doesn't control that space as they do within VR, the continued push with Ray-Ban – alongside the continued rise in AI – suggests they might. This feels like a space Apple should be playing in, and are reportedly exploring it, but clearly they have their hands full fixing the Vision Pro right now. And really, everyone in the smartglasses space is just working towards the goal of "true" AR glasses, the likes of which Meta and Snap have already previewed.

Back to VR, hope, remarkably, still springs eternal for Counterpoint. They believe shipments will rise again in 2025, thanks in part to AI integrations. I'm not clear why that would drive more headset sales, but okay. More compelling will be Google's (re)entry into the space alongside Samsung. But really, it will all come down to the two C's: cost and content.

The Quest 3S did well because it's so cheap and has access to a ton of content thanks to Meta's decade-long efforts in the space. Apple is finally – finally – getting its act together with regard to content. The first (short) film made with Hollywood talent was good. The just-released Metallica (short) concert, was great. If they can keep pushing this type of stuff out there – and if they get serious about gaming (the perpetual issue/promise with Apple across platforms) – people may actually be compelled to buy the Vision Pro again. Well, with a price cut.

If we really are about a year away from a refreshed Vision Pro, perhaps upgraded with an M5 chip and little else changed, Apple may be wise to do a price cut ahead of the holidays. How low can they go? Well, it's Apple. I imagine the most they cut it down to would be $2,499 – which is not nothing at $1,000 off, but it still is insanely expensive – $2,999 might be more likely.

But it's unlikely anything really moves the needle until they get to a non-Pro "Vision", perhaps in 2-3 years. If Apple can get that closer in price to $1,499, bolstered by (hopefully) a lot of Immersive Video and the like content at that point, it could actually sell some units.

Of course, by then, we may actually be fairly close to those true AR glasses. At least the first (shipping) versions. Until then – watch out below!

Update March 20, 2025: Just in case you needed another signal in terms of just how bad the VR headset market is at the moment...

1

And really more like 30 years in a row if we want to include Nintendo's Virual Boy attempt in 1995...