AI, Uh, Finds a Way

In December, DeepSeek dropped a bomb. Late last week, they detonated it. As markets around the world open today, we're about to see just how bad the fall-out will be. It undoubtedly will not be pretty. But the real question is: how far will it spread and just how quickly will it be cleaned up?

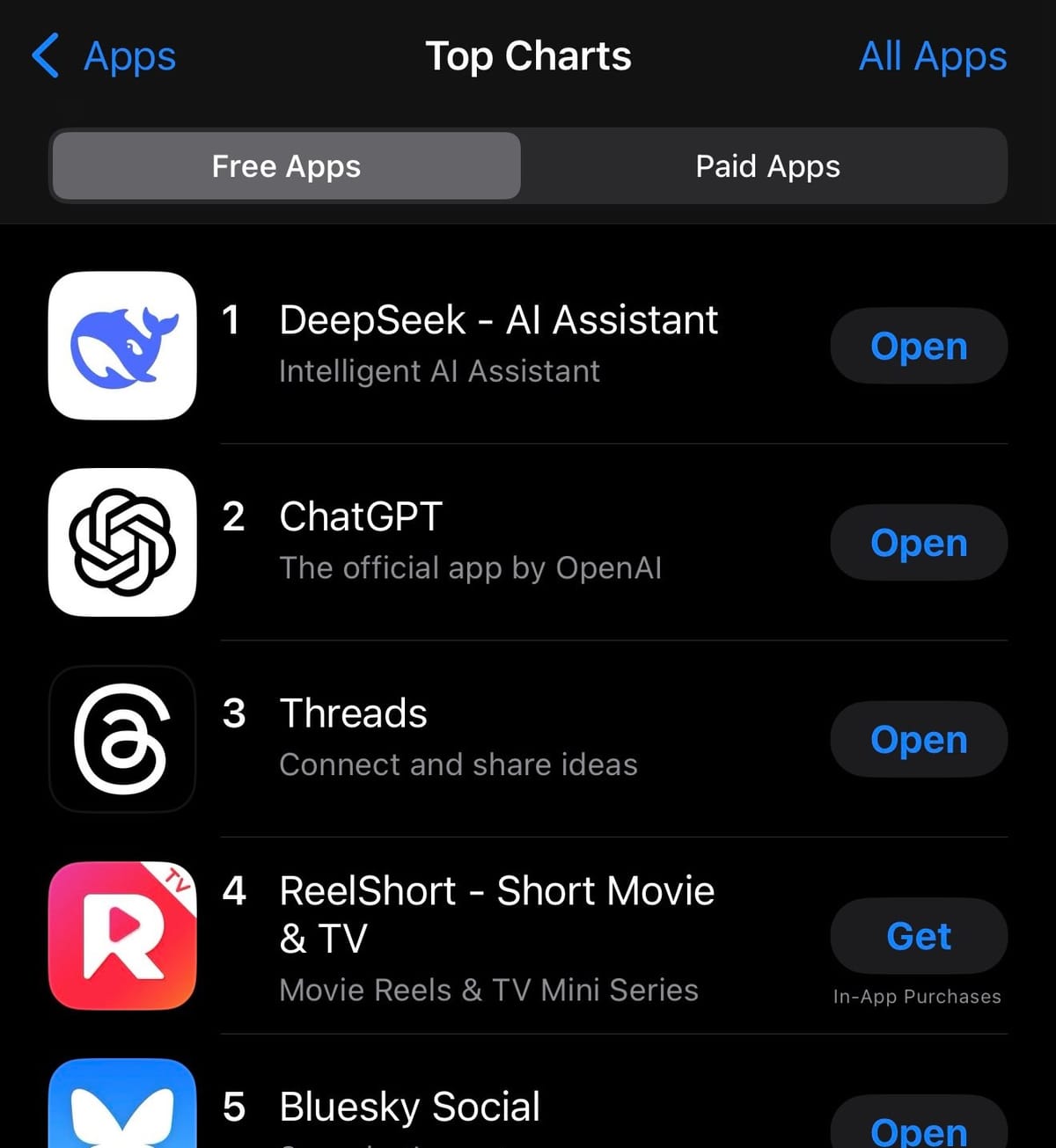

In less metaphorical terms, DeepSeek's release of their new R1 model last week that many say is at least comparable to OpenAI's o1 and other leading models has Wall Street shitting its pants. Why? Because the entire US stock market has been boosted on the back of Big Tech over the past few years. And more recently, many of those stocks have been boosted on the promise of AI. And that has led investors to largely turn a blind eye to the immense spend needed to built out that AI.

That was never going to last, a point I've been harping on for nearly a year now. This doesn't require Nostradamus, you simply have to be a student of history. Every cycle – certainly in tech – is the same. A new technology leads to a massive infrastructure build out. An arms race erupts as many players enter the land grab. But no one knows for sure how much spend will be required to "win" – because they can't possibly know – so the ramp continues until something stops it.

Yes, this is another way to describe a bubble. But it's not necessarily a bad thing, it's far more of a natural thing if you understand the underlying incentives. And if you believe that AI is the most transformational technology to come about in some time – some might say, ever – it just accelerates and expands everything in the cycle. As does the fact that again, Big Tech companies are now the largest and most well capitalized in the world. Hammer has met nail.

But there's no point hammering the nail after it's already been put in place. And that's the point that can't be predicted but is obvious once it's done. The question is if DeepSeek just pointed to the nail already hammered...

Wall Street is now worried that may be the case. I mean, how can a small Chinese startup, born out of a hedge fund, spend fractions in terms of both compute and cost and get similar results to Big Tech? That's what everyone is now scrambling to figure out – Meta, perhaps more than the others because their model with AI is similar to what DeepSeek seeks: an open-source (read: open-weight) model that permeates the industry and drives down costs, thus undercutting rivals who rely on charging for said models. Meta's problem here is that they're spending tens of billions of dollars to make such a model. And again, DeepSeek just did it for something a lot closer to $0 than to where Meta's spend is heading.1

But actually, if DeepSeek were really to upend this world, Meta would probably be okay relative to their peers in the space. They could pull back spend relatively quickly and easily if it's not needed. Google and Microsoft – and, by extension, OpenAI – are in a much trickier spot under such a scenario because their AI game plan is all about charging for the technology. They too can pull back spend, of course, but where does that leave them? OpenAI now has a brand and product moat, at least. But Google and Microsoft may have just gotten a drawbridge thrown over their moat.

They'll say that's not the case, of course. And they might be right. But they might be wrong! And again, that's what everyone from Wall Street to Big Tech is now scrambling to figure out today.

Already, we're seemingly getting a memo sent around to bring up Jevons paradox – the notion that an increase in efficiency leads to an increase in consumption. Translation: DeepSeek is great because it will lift all boats as AI can scale faster and further. Sure, at the highest level that's undoubtedly true! But the details matter. Microsoft is about $80B deep in the weeds this year. The CapEx numbers that Nadella has been so busy touting may have just become an albatross around their neck. And if that's the case, he's lucky (and perhaps prescient) to offload OpenAI's 'Stargate Project' spend to Oracle and others.

Meanwhile, where all of this leaves NVIDIA – the current king of the hill thanks to being the key company at the center of all of this spend – is either catastrophic or ultimately okay. The revenue ramp was already slowing, as it must given the law of large numbers, but if all of Big Tech decides to slash their CapEx at once... NVIDIA's stock price may suffer a heart attack. And again, that would ripple through the entire market. But in the Jevons paradox equation above, NVIDIA would ultimately be fine as they'd undoubtedly remain a key provider of the underlying technology now being used at greater scale (albeit with lower individual entity spend).

The others in Big Tech will make a similar case: that all of the data centers built will still be needed as AI goes global, but the jury remains out in terms of technology depreciation in this world and future. One big question: as we shift from a world of pre-training to a world of inference, are the same servers and chips going to be just as useful/good versus racks built specifically for that purpose? And DeepSeek's breakthroughs just made all of that even more complicated.

And while yes, just as in past booms, the build outs ended up being crucial for the future, those that spent on those build-outs usually didn't fare as well...

The real problem is that it won't be so simple to simply pull back spend. Beyond a lot of it already being committed, there's obviously still a very real risk that DeepSeek is just a blip on the radar and not the bomb that blows up everything. So none of Big Tech can really afford, quite literally, to let their feet off the gas just yet. Instead, they're going to have to try to recreate and study the methods the group used to create their models and see how replicable and scalable it is.

Either way, China has seemingly just taught the US a couple of valuable lessons. Really, they're related: one of unintended consequences and how restrictions breed creativity, of sorts. The US export restrictions on advanced AI technology such as NVIDIA chips, may have created a cauldron of innovation, as restrictions so often do. To quote the great Dr. Ian Malcolm, as one must in times like this: "Life, uh, finds a way." You may think you've put methods in place to stop the dinosaurs from breeding, but...

I'll end quoting another Jurassic Park legend, Ray Arnold, as the US markets get ready to open: "Hold on to your butts..."

Update: After this post, Alex Kantrowitz of Big Technology pinged me to see if I'd do an "Emergency Podcast" to discuss the 'DeepSeek Reckoning'. Fun chat.

You can find it on YouTube below or Apple/Spotify.

1 Another fun wrinkle in all this: Meta board member Marc Andreessen calling this "AI's Sputnik moment"...