AI DIVINE

Yes, I made the joke in my newsletter a few days ago, but I still can't believe no one else seems to be talking about how NVIDIA backwards spells AIDIVN – which is gibberish, but starts with "AI" and almost seems to be short for "AI Divine". I bring this up because holy shit, NVIDIA is now the most valuable company in the world.

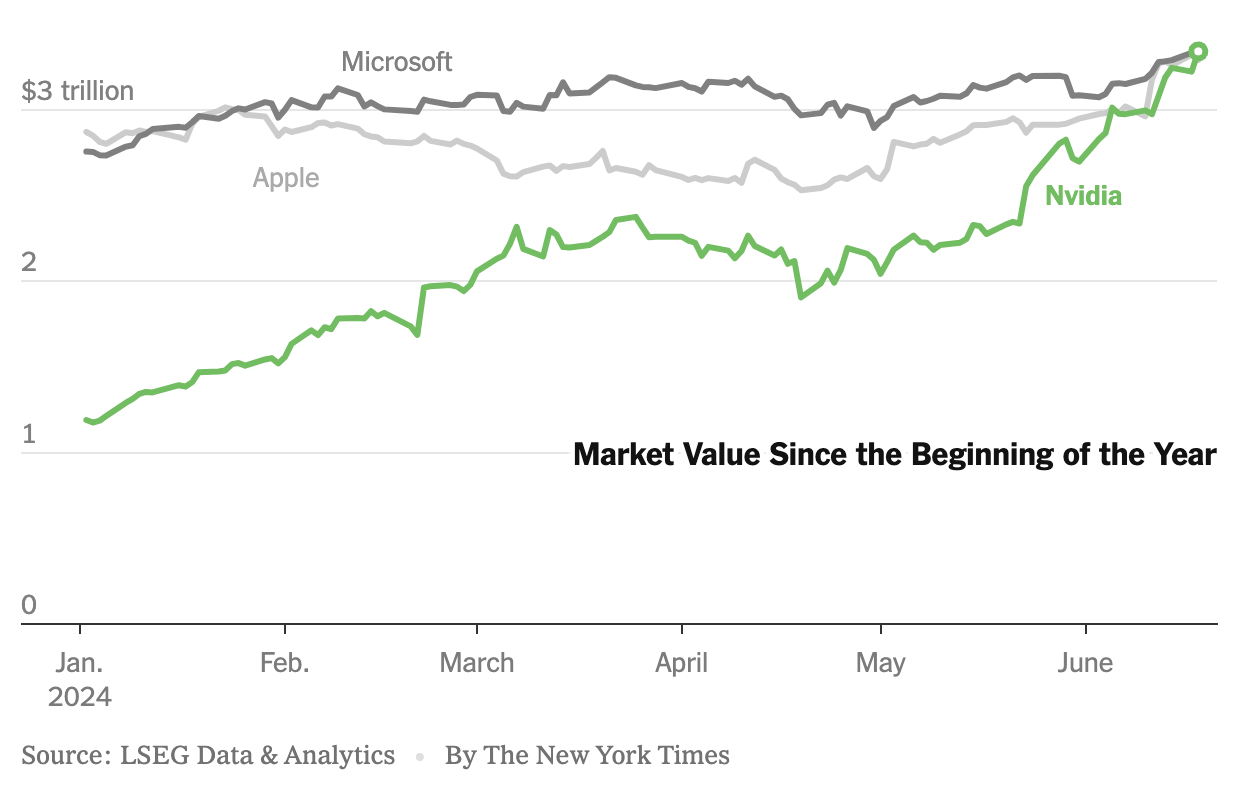

I noted this was just a matter of time after they passed Apple in market cap two weeks ago. Now, sure enough, down goes Microsoft.

To be clear, certainly that company and now even Apple are benefitting from the AI boom cycle, but nothing compared to what NVIDIA is seeing. Here's Tripp Mickle and Joe Rennison for The New York Times:

Nvidia’s rise is among the fastest in market history. Just two years ago, the company’s market valuation was over $400 million. Now, in the span of a year, it has gone from $1 trillion to more than $3 trillion.

On Tuesday, Nvidia’s share price rose 3.6 percent, lifting its value above $3.3 trillion. Microsoft and Apple both fell, ending the day trailing the Silicon Valley chip maker.

It's just a stunning rise any way you slice the numbers. But is it sustainable?

The speed at which Nvidia’s value has grown has been startling. Apple crossed $1 trillion in August 2018 and became the first $3 trillion company last June. Microsoft also took nearly five years to climb from $1 trillion to $3 trillion.

But Nvidia’s investors are betting more on its potential than on its current profits. Microsoft and Apple generate more than $85 billion in annual profits, while Nvidia generates $42.6 billion.

What matters there, of course, is not the number but the growth rate. Stock prices are indicative of future profit potential, not current, and NVIDIA sales tripled in the past year, while Microsoft and Apple have grown (or not grown, in the case of Apple) at rates more reasonable for public companies – let alone companies which are decades old and valued over $3T.

Still, certainly a part – and likely a large part – of the run-up in NVIDIA's stock is simply exuberance, irrational or not, around AI and the notion that NVIDIA is the most straightforward bet to place in that space. It's less like the GameStop nonsense and perhaps more akin to what happened with Tesla a few years ago, when the company was valued far more than all other car companies combined. It still is, but the stock has come back to Earth a bit with the period of exuberance over and the realities of the world setting in.

The same thing will happen to NVIDIA at some point, but the question is when and how high can the stock go before then? If I knew that, I would place a bet (one way or the other), but the reality is that no one does. I asked ChatGPT to guess recently and – well, it sort of hallucinated. Can you blame it? Trying to parse this stock run, I'd hallucinate too. Kudos to CEO Jensen Huang for keeping it together.

Especially in the midst of a pretty obvious/cliched market top signal:

Nvidia’s ascent has made Mr. Huang a celebrity in the tech world. After a computer conference in Taiwan early this month, he was surrounded by attendees who wanted his autograph, including a woman who asked him to sign her chest.

The company’s rise is reminiscent of dot-com era titans like Cisco and Juniper Networks, which built the equipment that ran communications networks for the internet. Cisco’s shares increased more than a thousandfold between its initial public offering in 1990 and 2000, when it briefly became the world’s most valuable company.

You hear a lot of folks bring up this Cisco comparison, and so Asa Fitch of The Wall Street Journal went ahead and asked John Chambers, who was CEO of Cisco during their boom time, for his assessment:

John Chambers, who was chief executive of Cisco during the dot-com boom, said there are some parallels, but the dynamics of the AI revolution are different from previous ones such as the internet and cloud computing. Chambers, now a venture investor, has made big bets on AI in cybersecurity and other arenas.

“The implications in terms of the size of the market opportunity is that of the internet and cloud computing combined,” he said. “The speed of change is different, the size of the market is different, the stage when the most valuable company was reached is different.”

As noted, Chambers is somewhat biased given his current job investing in AI, but that doesn't mean he's wrong.

Chambers said Huang was working from a different playbook than Cisco but was facing some similar challenges. Nvidia has a dominant market share, much like Cisco did with its products as the internet grew, and is also fending off rising competition. Also like Nvidia, Cisco benefited from investments before the industry became profitable.

“We were absolutely in the right spot at the right time, and we knew it, and we went for it,” Chambers said.

Of course, it didn't end well for Cisco. Not awful, mind you, the company was and is still important and around, of course. But there was roughly two decades of stock stagnation following the Dot Com collapse. Today, Cisco is a $185B company. At its peak in March of 2000, it was valued at $555B.

Back to Fitch on Huang:

With the rise of the stock, he has taken on an aura of stardom usually reserved for pop singers and athletes, not 61-year-old tech executives. At the company’s annual conference in March, Huang gave his keynote speech from a stage at an 11,000-capacity arena; in Taiwan, he was pictured autographing the chest area of a woman’s shirt.

A different playbook, indeed. Can NVIDIA hang on where Cisco could not?

One more thing: jokes aside, the name "NVIDIA" comes from the Latin word "Invidia" which means "Envy". Reverse that word and we get, "AIDIVNI". "Divni" roughly translates from Latin into "Divine".