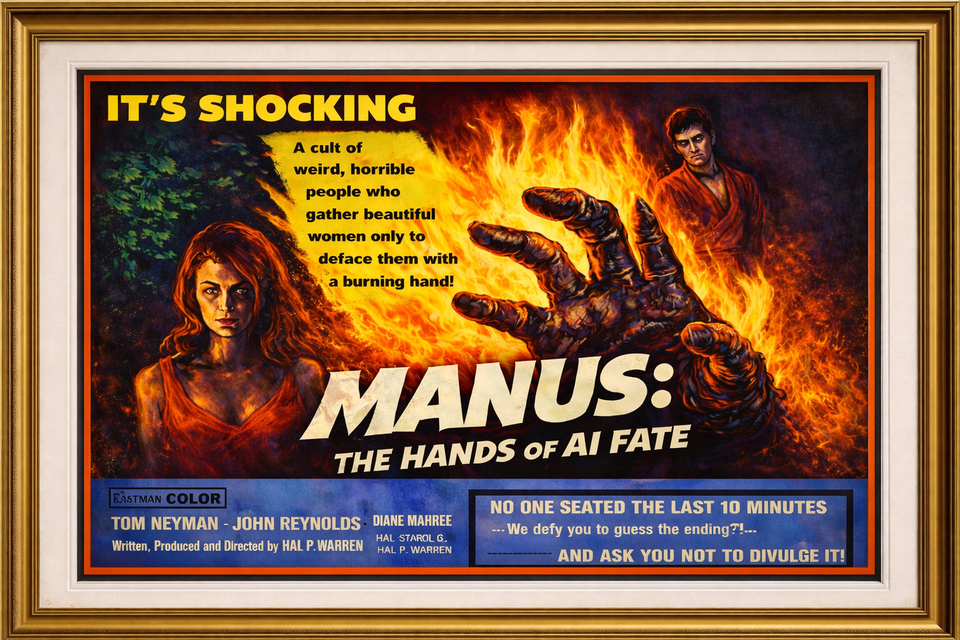

Manus: The Hands of AI Fate

Between Apple and Meta, I think it was a pretty close call in terms of which Big Tech company had the worse 2025 when it came to AI. Both had to completely overhaul their approaches after embarrassments. But only one has had to spend billions, let alone tens of billions, and perhaps hundreds of billions to correct the mistakes – at least so far.1 And so Meta clearly wanted to end their no-good-very-bad-year on a high note. As Angel Au-Yeung, Raffaele Huang, and Kate Clark report for WSJ:

Meta has agreed to acquire AI startup Manus, a Singapore-based company with Chinese founders that conducts deep research and performs other tasks for paying users.

Meta is closing the deal at more than $2 billion, according to people familiar with the acquisition. Manus was seeking a fresh round of fundraising with a valuation of $2 billion when Meta approached the startup, some of the people said.

Given that Manus is apparently well past $100M in ARR and still growing fast, such valuations seem almost reasonable. Then again, the Chinese origins of the parent company, Butterfly Effect, have long lingered over the company, presumably even with an official move to Singapore. As such, Meta perhaps smelled an opportunity. One that helps their AI narrative, at least from a business-perspective, immediately.

While their Big Tech peers, Microsoft, Google, and Amazon are all monetizing their AI initiatives both through upselling their cloud offerings and by selling the AI products directly to customers, Meta is doing neither. At best, they're indirectly monetizing their AI by leveraging it to bolster their existing businesses in ads – but those others are doing that as well. So it's sort of a tough sell to Wall Street, if nothing else, especially when your AI build-out spend is on par with those players – or even higher when it comes to things like compensation.

And unlike the nearly $15B Scale deal, where a "hackquisition" saw them acquire only 49% of that business, Meta gets the whole enchilada here. That is to say, they're buying the actual business, which gives them an AI business overnight:

Meta says it plans to continue to operate and sell Manus’s service and integrate it into its suite of social-media products. Meta has previously touted so-called open source models that are largely free to access, modify or distribute.

“We plan to scale this service to many more businesses,” Meta said in its announcement about the deal.

Okay, but does that mean Meta's businesses or the businesses of others? Well, their own post on the deal seems to answer that right in the title, "Manus Joins Meta: Accelerating AI Innovation for Businesses":

We are excited to announce that Manus is joining Meta to bring a leading agent to billions of people and unlock opportunities for businesses across our products.

Translation: Meta just bought into the enterprise market!

Now, whether or not other businesses will want to buy enterprise offerings from Meta is another matter. But I suspect keeping the separate Manus branding, with the Meta firepower and resources behind the scenes, could help them here. They'll undoubtedly still face the same challenges that others trying to break into enterprise sales run into, from Google on down. Selling into enterprise is just a different beast which requires different muscles. It took Google bringing on board Thomas Kurian from Oracle for this to truly work (with the necessary growing pains along the way). With that in mind:

Manus’s co-founder and chief executive, Xiao Hong, who often goes by the nickname “Red,” will report to Javier Olivan, chief operating officer of Meta, some of the people said.

When you hear that Meta is doing another massive AI deal, you would obviously assume it's to bolster the AI group now being run under former Scale chief Alexandr Wang. But again, this deal is different – it's a deal to create a new business arm of AI, so reporting to the COO makes sense.

At the same time, the tech Manus has built can obviously help Meta's other AI efforts, including across their consumer-facing products. The core Manus product is well-regarded by many thanks to its agentic-first approach. But they also don't run on their own models, but instead, use multiple models from the likes of Anthropic and Alibaba. Will that continue under Meta? Meta would undoubtedly love that, but will those other companies that compete more directly with Meta? Unclear. Regardless, eventually, one would assume that Meta would want their own new models helping to power Manus.

So all of this plays into Meta's broader AI ambitions and goals as well. And the company undoubtedly wanted to make that clear by having Wang tweet his excitement about the deal, lest you think this is yet another sign of internal turmoil within Meta.

This deal seemingly makes a lot of sense for Meta on a few fronts. And it also may point to the start of a renewed push into enterprise. Again, easier said than done, but don't be shocked if this is a wedge of sorts. If they can keep Manus expanding into businesses, we should see other Meta cloud offerings follow, putting them more in line with those aforementioned Big Tech peers.2 And perhaps easing some concerns Wall Street has with regard to their AI spend.

Meta has, of course, tried this push into eterprise before in ways – from Workplace on down – but it hasn't really worked. But buying up a hot product, team, and tech is what Meta does best! Just ask the FTC...3

One more thing: As for those China-ties, consider them completely severed. As Yifan Yu and Cissy Zhou report for Nikkei Asia:

Meta says it will acquire AI startup Manus and that the Singapore-based company will no longer have any Chinese ownership or operations in China after the deal, while a source close to the matter put the value of the transaction at between $2 billion and $3 billion.

What at first looked like a questionable decision by Benchmark to invest in Butterfly Effect given the geopolitical risk, METAmorphosing into a savvy bet and quick exit.

1 While Apple did zero large AI deals in 2025, Meta ended up doing two... ↩

2 Moves which OpenAI is already talking about making as well, clearly as a preview to help justify their own AI spend... ↩

3 Just in case my title (and image) make zero sense to you... ↩